AbbVie makes two major acquisitions to boost its pipeline

- $19 billion in a week: AbbVie’s two big bets

- AbbVie doubles down on cancer and neurology

- Replacing falling revenue from top sellers

- Acquisitions of biotech ImmunoGen and Cerevel Therapeutics

- Transforming AbbVie’s pipeline

- Satiating AbbVie’s deal-making hunger

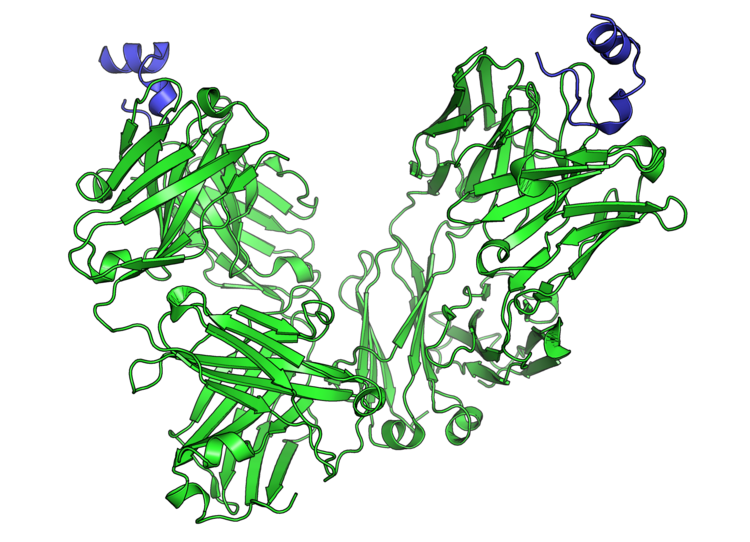

Pharmaceutical company AbbVie has made two significant acquisitions in less than a week, totaling $19 billion. The Chicago-based company, known for selling Botox and immune-disease drug Humira, has doubled down on its investments in cancer and neurology. With the acquisitions of biotech companies ImmunoGen and Cerevel Therapeutics, AbbVie aims to replace falling revenue from its top sellers and transform its pipeline. These deals have satiated AbbVie’s deal-making hunger and positioned the company for future growth.

Public Companies: AbbVie (ABBV), ImmunoGen (IMGN), Cerevel Therapeutics (CERE)

Private Companies:

Key People:

Factuality Level: 7

Justification: The article provides information about AbbVie’s recent acquisitions of ImmunoGen and Cerevel Therapeutics. The information seems to be based on factual announcements made by AbbVie. However, the article lacks in-depth analysis and context about the acquisitions and their potential impact on AbbVie’s pipeline in cancer and neurology. It also does not provide any independent sources or perspectives to support the claims made. Overall, the article seems to present the information accurately but lacks in-depth analysis and context.

Noise Level: 3

Justification: The article provides information about AbbVie’s recent acquisitions in the pharmaceutical industry. However, it lacks in-depth analysis, evidence, and actionable insights. It mainly focuses on the financial aspects of the deals and does not explore the long-term trends or consequences of these acquisitions. The article also contains repetitive information and does not provide a critical perspective on AbbVie’s decision-making or the potential impact on patients or the healthcare industry.

Financial Relevance: Yes

Financial Markets Impacted: Pharmaceutical industry, healthcare sector

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article pertains to financial topics as it discusses the acquisitions made by AbbVie, a pharmaceutical company. However, there is no mention of an extreme event or its impact.

www.wsj.com

www.wsj.com  www.marketwatch.com

www.marketwatch.com