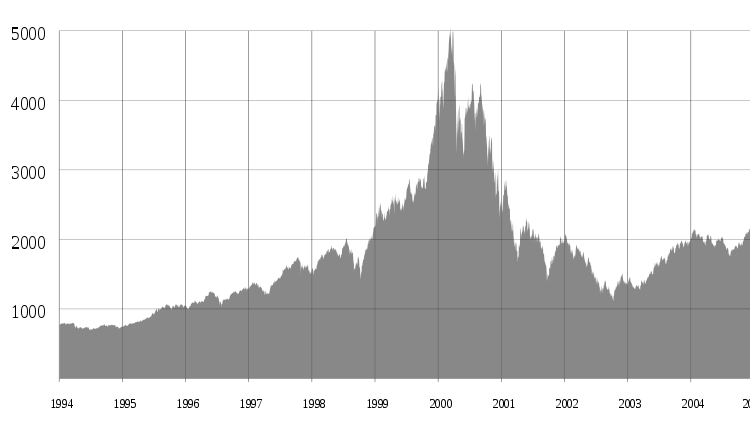

How Nvidia’s Rise Compares With Apple and Microsoft

- Nvidia’s market capitalization crosses $2 trillion in intraday trading

- Shares of the chip maker gained 0.4% to $788.67

- Nvidia reached $1 trillion market cap in less than a year

- Only Apple and Microsoft have closed at the $2 trillion level

- Nvidia’s stock rose 16% following blowout earnings

- UBS analyst lowers price target on Nvidia due to potential revenue growth slowdown

- Nvidia shares have gained 59% this year

Nvidia’s market capitalization crossed the $2 trillion mark in intraday trading, with shares gaining 0.4% to $788.67. This milestone puts Nvidia in the same league as Apple and Microsoft, the only other companies to have closed at the $2 trillion level. What sets Nvidia apart is its rapid rise, reaching $1 trillion market cap in less than a year. The chip maker’s stock rose 16% following its blowout earnings report, solidifying its dominance in providing hardware for AI systems. However, some analysts are cautious about a potential slowdown in revenue growth. UBS analyst Timothy Arcuri lowered his price target on Nvidia, citing a possible ‘steady state’ in revenue over the coming quarters. Despite this, Nvidia shares have gained 59% year-to-date, outperforming the S&P 500 and Nasdaq Composite.

Factuality Level: 2

Factuality Justification: The article provides accurate information about Nvidia’s market capitalization and recent stock performance. However, it includes unnecessary details about other companies reaching the $2 trillion mark and analyst opinions that are tangential to the main topic. The article also lacks depth and context about Nvidia’s growth and the factors driving its stock performance.

Noise Level: 2

Noise Justification: The article provides relevant information about Nvidia’s market capitalization crossing the $2 trillion mark and the factors contributing to its growth. It includes details about the company’s stock performance, analyst opinions, and comparisons with other tech giants like Apple and Microsoft. The article stays on topic and supports its claims with data and examples. However, it lacks in-depth analysis of long-term trends or antifragility concepts, which prevents it from scoring higher.

Financial Relevance: Yes

Financial Markets Impacted: Nvidia’s market capitalization and stock performance

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article discusses Nvidia’s market capitalization and stock performance, which are relevant financial topics. There is no mention of an extreme event.

Public Companies: Nvidia (NVDA), Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL)

Key People: Timothy Arcuri (UBS analyst)

Reported publicly:

www.marketwatch.com

www.marketwatch.com