Understanding the fine print and finding the best rates

- Interest rates are expected to cool soon

- Some savings accounts are still paying 6.17% APY

- Understanding the fine print is crucial when choosing an account

- Consistently high inflation has led to higher savings rates

- Not all financial institutions are motivated to offer high-yielding accounts

- Consider the bank’s reputation and potential restrictions before opening an account

- Ensure your money is protected from potential bank failure

- A high interest rate can significantly increase earnings

- Here are 10 of the best-paying high-yield savings accounts in March 2024

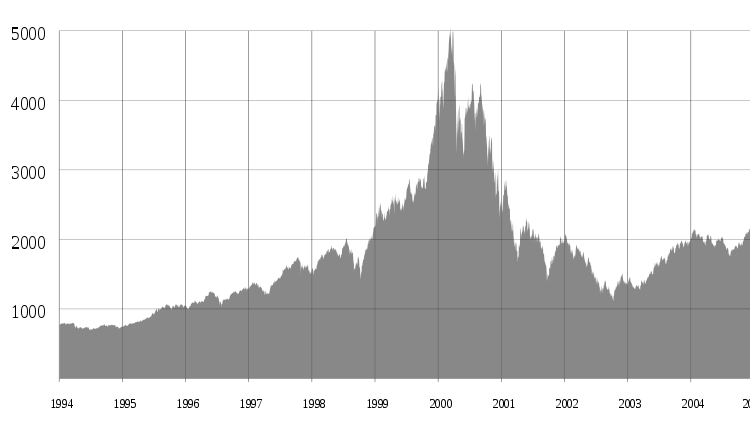

Experts predict that interest rates will begin to cool after a period of steady increase. However, there are still savings accounts available that offer a high annual percentage yield (APY) of 6.17%. It’s important to understand the fine print and consider the reputation of the bank before choosing an account. Some financial institutions are motivated to offer high-yielding accounts due to consistently high inflation and the need to raise capital. However, not all banks are as motivated. It’s crucial to ensure that your money is protected from potential bank failure by keeping it in FDIC-insured accounts. While a high interest rate can significantly increase earnings, it’s important to read and understand the restrictions and potential fees associated with the account. Here are 10 of the best-paying high-yield savings accounts in March 2024, with details on their APY and any restrictions or requirements.

Factuality Level: 3

Factuality Justification: The article provides information about high-yield savings accounts and interest rates, but it lacks depth and context. It includes some relevant details about why some banks offer higher rates, but it also contains repetitive information and unnecessary background details. The article does not provide a comprehensive analysis of the topic and may oversimplify some aspects of savings accounts and interest rates.

Noise Level: 3

Noise Justification: The article provides detailed information about high-yield savings accounts and the factors influencing interest rates. It includes expert opinions and advice on what to consider when choosing a savings account. The content is relevant and informative, focusing on a specific topic without diving into unrelated territories. However, some information is repetitive, such as the list of high-yield savings accounts, and the article could benefit from more critical analysis of the banking industry.

Financial Relevance: Yes

Financial Markets Impacted: The article discusses interest rates and savings accounts, which can impact financial markets and financial institutions.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article primarily focuses on interest rates and savings accounts, which are financial topics. There is no mention of any extreme events.

Private Companies: Boeing Employees’ Credit Union,Digital Federal Credit Union,Andrews Federal Credit Union,Poppy Bank,BrioDirect,My Banking Direct,Customers Bank,Ivy Bank,Western Alliance Bank,TAB Bank

Key People: Greg McBride (Chief Financial Analyst at Bankrate), Matt Kasper (Executive Advisor at Modern Wealth Management), Elizabeth Ayoola (Personal Finance Expert at Nerdwallet), Gary Zimmerman (CEO of MaxMyInterest)

www.marketwatch.com

www.marketwatch.com