Last year’s blockbuster concerts and the tax implications of ticket resales

- Do I need to report concert ticket resales on my tax return?

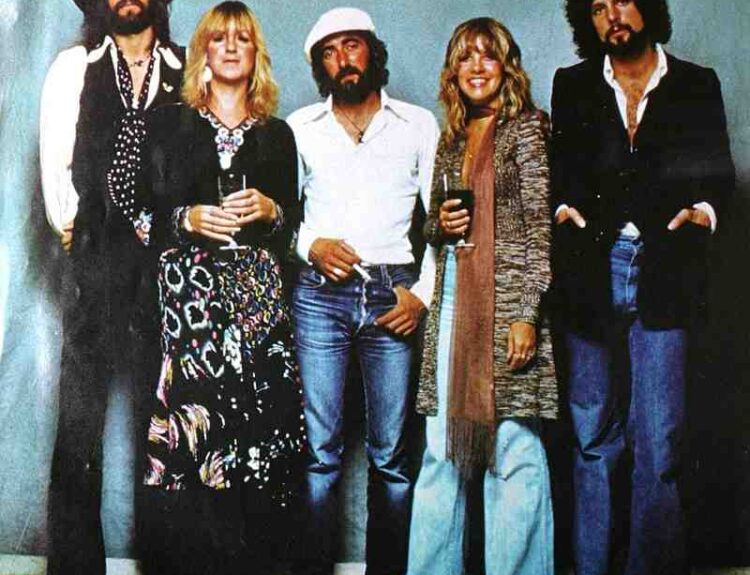

- Last year was a busy year for live music with blockbuster concerts

- Ticket resales should be reported on Schedule D (Form 1040)

- You may not need to pay taxes on the profit from ticket resales

- Ticket fees can help reduce the taxable profit

- Personal losses from ticket resales should also be included on the tax return

- Third-party payment platforms may be required to send a 1099-K tax form

- The reporting threshold for the 1099-K drops to $5,000 in 2024

- Even if you don’t receive a 1099-K, the income from ticket resales is still taxable

- It’s important to report all sales, even personal losses, to avoid potential IRS audits

Dear Tax Guy, I’ll keep it short and sweet. Do I have to put concert ticket resales on my Schedule D when filing my income-tax return? I made a profit when I resold them. Whistling “Taxman” by The Beatles. Yes, you should report the ticket resale on your income-tax return through a Schedule D (Form 1040). You just might not need to pay taxes on it. Last year was a great one for live music: Taylor Swift, Beyonce, Morgan Wallen, Ed Sheerhan, BLACKPINK and on and on. I vividly recall a Bruce Springsteen concert at MetLife Stadium last August. (And yes, I just involuntarily said “Bruuuuuce!”)I assume questions on ticket resales will only become more common. So turn up the Beatles’ “Taxman” and read on. The Schedule D is needed to report a capital gain or loss on your income taxes. Another necessity is the Form 8949, which lists the sales and dispositions summarized in the Schedule D. (If someone makes ticket resales their business, they’d be submitting a Schedule C on business income and losses, she noted.) It’s also easy to think of capital gains as having a preferential tax rate. Yet those rates of 0%, 15% and 20% only apply if it’s been at least a year since the asset was acquired. When the resale is within a year, the proceeds are treated as ordinary income. So the taxman lumps it with wages, bank-account interest and other money. A ticket’s fees also are part of the cost in addition to its face value, said Nicole DeRosa, partner at Wiss, an accounting and consulting firm with offices in New York, New Jersey and Florida. That would push up the cost-basis and shrink the taxable profit. The sale at the personal loss should also be included on the Schedule D and Form 8949, but it would reflect a disallowed personal loss, she noted. In other words, the tax code can’t help you if you lost money when unloading a ticket because your friend bailed at the last minute. Third-party payment platforms like PayPal PYPL, +1.81%, Venmo and Stubhub are also required to send the 1099-K tax form to people receiving the payment in exchange for goods and services. The general threshold to activate a form is currently $20,000 and more than 200 transactions. The form was supposed to kick in with at least one payment worth $600. But last year the Internal Revenue Service decided it would hold off on the threshold. It was the agency’s second year pausing implementation, and avoiding potential taxpayer confusion is one reason for doing so. In 2024, the reporting threshold drops to $5,000. I thought it was tricky leaving the MetLife Stadium parking lot after the Springsteen show. It’s a sail compared to the rules on the 1099-K, and how they may or may not relate to taxes on a ticket resale. The 1099-K is not meant to document and report the casual payments back and forth between family and friends — say, for a ticket. It’s focused on reporting the money paid for goods and services. But even if you aren’t getting a 1099-K on a sold spare ticket, the IRS says it’s still taxable. Erin Collins, the IRS National Taxpayer Advocate, dug into the issue last month. The title of her blog post was replete with Taylor Swift references: “If You Resold the Hottest Ticket of Summer 2023, You Likely Didn’t Receive a Form 1099-K — But This Won’t Last Forever & Always.” “Whether you receive a Form 1099-K or not, the income from the sales of goods or services is taxable, and you will need to include it on your tax return,” Collins wrote. You may ask, “Who’s going to know if the resale doesn’t make it to the return?” But it’s worth reporting sales of a personal loss, in case the IRS starts asking questions, DeRosa said. Meanwhile, the profit on a resold ticket is income like other sources of income, said Cynthia Leachmoore, an enrolled agent at Soquel Tax Service in Soquel, Calif., and current president of the National Association of Enrolled Agents. Leave that off your tax return at your risk, and keep your fingers crossed that the IRS does not decide to audit your return.

Factuality Level: 3

Factuality Justification: The article provides relevant information about reporting concert ticket resales on income-tax returns, including the need for Schedule D and Form 8949. However, the article contains unnecessary tangents such as personal concert experiences, references to songs, and details about IRS thresholds for Form 1099-K. These digressions detract from the main topic and make the article less focused and informative.

Noise Level: 3

Noise Justification: The article provides clear and relevant information on whether concert ticket resales should be reported on income-tax returns. It explains the process of reporting on Schedule D and Form 8949, as well as the implications of capital gains and losses. The article also touches on the Form 1099-K and the importance of reporting income from ticket resales. While there are some mentions of personal experiences and references to popular culture, they do not detract significantly from the overall informative content of the article.

Financial Relevance: Yes

Financial Markets Impacted: The article provides information on reporting ticket resales on income-tax returns, which may impact individuals who engage in ticket reselling as a business.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article discusses the tax implications of ticket resales, which is relevant to individuals involved in the financial aspect of ticket reselling.

Public Companies: PayPal (PYPL)

Key People: Nicole DeRosa (Partner at Wiss), Erin Collins (IRS National Taxpayer Advocate), Cynthia Leachmoore (Enrolled Agent at Soquel Tax Service)

Reported publicly:

www.marketwatch.com

www.marketwatch.com