Company’s net profit and revenue exceed expectations

- Great Wall Motor shares rose 9.8% on strong Q1 results

- Net profit increased to 3.23 billion yuan, up from 174.2 million yuan last year

- Record revenue of 42.86 billion yuan driven by higher selling prices and overseas sales

- Gross margin improvement supported by 79% increase in export volumes

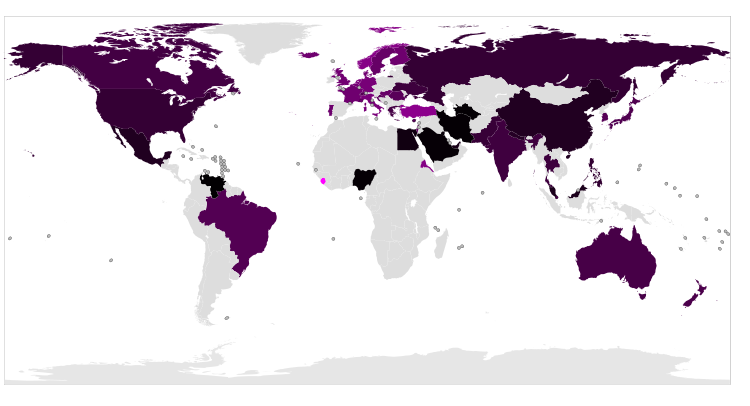

- Deutsche Bank expects Russian sales volumes to rise further this year

Great Wall Motor shares experienced a significant surge as the company reported its first-quarter results, surpassing analysts’ predictions. The company’s net profit rose to 3.23 billion yuan, a substantial increase from the previous year’s 174.2 million yuan. This growth was attributed to sales growth and an improved sales structure. Additionally, the company achieved record revenue of 42.86 billion yuan, driven by higher average selling prices of its vehicles and strong sales in overseas markets. Great Wall Motor’s gross margin also improved, supported by a 79% increase in export volumes. Deutsche Bank analyst Bin Wang praised the company’s performance, stating that it exceeded market expectations. The bank expects Russian sales volumes to continue rising, as global brands have reduced vehicle supply in the country following the Ukraine invasion. As a result, Deutsche Bank raised its target price on Great Wall Motor’s H shares.

Factuality Level: 8

Factuality Justification: The article provides specific details about Great Wall Motor’s first-quarter results, including net profit, revenue, and analyst comments. It does not contain irrelevant information, misleading content, sensationalism, or bias. The information presented is based on factual data and analyst reports, contributing to a high factuality level.

Noise Level: 3

Noise Justification: The article focuses on the positive performance of Great Wall Motor in the first quarter, providing specific details about the increase in net profit, revenue, and share prices. It includes comments from an analyst praising the company’s results and outlook. While the article lacks critical analysis or exploration of potential risks or challenges facing the company, it stays on topic and provides relevant information supported by data.

Financial Relevance: Yes

Financial Markets Impacted: Great Wall Motor

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article pertains to financial topics as it discusses Great Wall Motor’s first-quarter results and the impact on its shares. There is no mention of any extreme event.

Public Companies: Great Wall Motor (N/A)

Key People: Bin Wang (Deutsche Bank analyst)

www.marketwatch.com

www.marketwatch.com