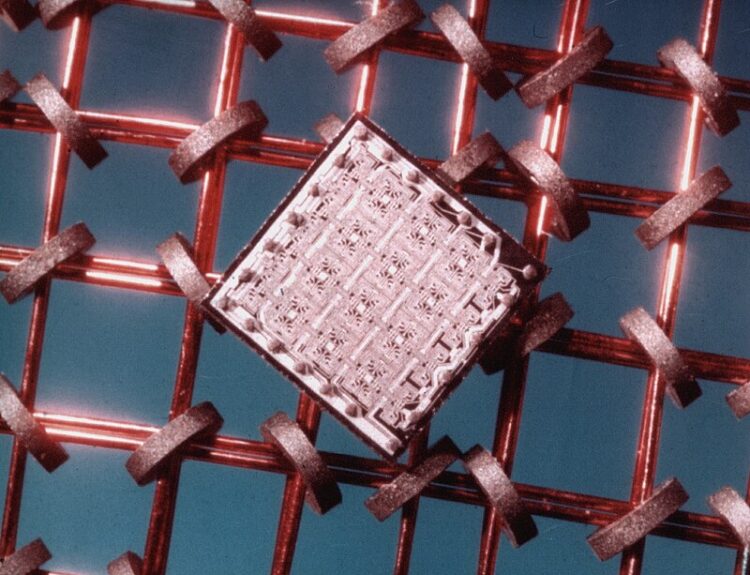

European chip maker expects revenue of $14 billion to $15 billion this year

- STMicroelectronics cuts sales guidance for the year

- Expects revenue of $14 billion to $15 billion

- Gross margin now anticipated to be in the low 40s

- Slowdown in demand for chips in the automotive sector

- Low demand for semiconductors in consumer devices

- Automotive industry no longer providing lifeline to chip sector

- Revenue in Q1 slumped 18% to $3.47 billion

- Net profit plunged to $513 million from $1.04 billion

- STMicroelectronics targeting revenue of $3.2 billion for current quarter

- Gross margin expected to be 40% for current quarter

STMicroelectronics has lowered its sales and margin forecasts for the year due to a slowdown in demand for chips in the automotive sector. The company now expects revenue of $14 billion to $15 billion, compared to the previous range of $15.9 billion to $16.9 billion. The gross margin is anticipated to be in the low 40s, down from the previously expected low to mid-40s. This comes as the chip industry has been facing low demand for semiconductors in consumer devices, while the automotive industry, which has been a lifeline for the sector, is also experiencing a slowdown. In the first quarter, STMicroelectronics reported a revenue slump of 18% to $3.47 billion, with net profit plunging to $513 million from $1.04 billion. For the current quarter, the company is targeting revenue of $3.2 billion and a gross margin of 40%.

Factuality Level: 8

Factuality Justification: The article provides specific details about STMicroelectronics’ financial performance, including revenue targets, gross margin, and forecasts. It also mentions the reasons behind the company’s lowered sales and margin forecasts, such as the slowdown in demand for chips in the automotive sector. The information is presented in a factual manner without significant bias or sensationalism.

Noise Level: 3

Noise Justification: The article provides detailed information about STMicroelectronics’ financial performance, changes in revenue forecasts, and factors affecting the semiconductor industry. It includes specific numbers, percentages, and quotes from company officials. The article stays on topic and does not dive into unrelated territories. However, it lacks in-depth analysis, antifragility considerations, and accountability of powerful people.

Financial Relevance: Yes

Financial Markets Impacted: The article provides information about STMicroelectronics lowering its sales and margin forecasts for the year due to weaker demand in the automotive industry. This could impact the company’s financial performance and potentially affect the semiconductor industry as a whole.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article focuses on financial forecasts and performance of STMicroelectronics, indicating its relevance to financial topics. However, there is no mention of an extreme event or any specific event that would warrant an impact rating.

Public Companies: STMicroelectronics (STM), Tesla (), Samsung Electronics (), Apple ()

Key People: Mauro Orru ()

Reported publicly:

www.wsj.com

www.wsj.com