Positive assessment of the market during high interest rates

- Stockland narrows goal for residential property settlements

- Development operating profit margins expected to stay in the low 20% area

- Default and cancellation rates below peak of previous cycles

- Enquiry levels up strongly over 3Q

- Sales volumes expected to remain stable in the near term

- Leasing spreads positive in Commercial Property business

- Stockland maintains FY 2024 pretax funds from operations guidance

- Annual funds from operations per security in a range of 34.5-35.5 Australian cents

- Total distribution likely to be within a target payout ratio of 75-85% of funds from operations after tax

Stockland has narrowed its goal for residential property settlements in the current fiscal year, expecting to settle between 5,300 and 5,500 residential lots. Development operating profit margins are projected to stay in the low 20% area. Default and cancellation rates are running higher than historical averages but are below previous cycle peaks. Enquiry levels have increased strongly over the third quarter, with stable month-on-month levels. Sales volumes are expected to remain stable in the near term, depending on the outlook for interest rates and market recovery in Victoria. In the Commercial Property business, leasing spreads have been positive. Stockland maintains its guidance for annual funds from operations per security and expects a total distribution within the target payout ratio.

Factuality Level: 8

Factuality Justification: The article provides a straightforward report on Stockland’s narrowed goal for residential property settlements, assessment of the market, operating profit margins, default and cancellation rates, enquiry levels, sales volumes, and leasing spreads. The information is presented in a clear and factual manner without any significant bias, opinion, or irrelevant details.

Noise Level: 3

Noise Justification: The article provides specific information about Stockland’s narrowed goal for residential property settlements, operating profit margins, default and cancellation rates, enquiry levels, sales volumes, and leasing spreads. It also includes guidance for annual funds from operations and total distribution for the year. The article stays on topic and does not dive into unrelated territories. However, it lacks in-depth analysis, accountability, and scientific rigor.

Financial Relevance: Yes

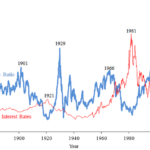

Financial Markets Impacted: Residential property market, interest rates

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article discusses Stockland’s narrowed goal for residential property settlements and provides a positive assessment of the market during a period of high interest rates. There is no mention of any extreme events or their impact.

Public Companies: Stockland (STK.AX)

Key People:

Reported publicly:

www.marketwatch.com

www.marketwatch.com