Investors React Positively to DuPont’s Announcement

- DuPont announces plans to split into three separate companies

- CEO Ed Breen to step aside, CFO Lori Koch will take over as CEO

- Each company will have greater flexibility for focused growth strategies

- DuPont following General Electric’s playbook with a successful breakup

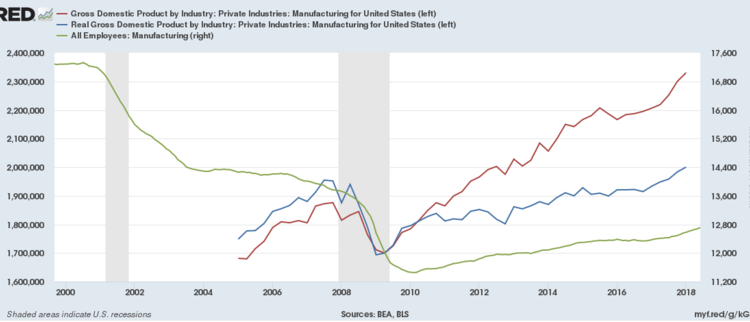

- Dow and DuPont’s agricultural businesses (Corteva) outperformed the S&P 500 since spinoff

DuPont has announced plans to split into three separate companies, following the successful model of General Electric’s breakup. The materials giant will focus on medical, industrial, construction, and automotive markets, while a new electronics business will serve the semiconductor industry, and a water company will offer filtration and purification technologies. DuPont’s CEO Ed Breen will step aside, with CFO Lori Koch taking over as CEO. Investors have reacted positively to the news, with shares up 4.4% in premarket trading.

Factuality Level: 9

Factuality Justification: The article provides accurate and objective information about DuPont’s decision to break into three separate companies, including details about each company’s focus, CEO statements, and historical context with GE’s similar move. It also includes relevant financial data and performance comparisons. The article is free from sensationalism, bias, and irrelevant information.

Noise Level: 6

Noise Justification: The article provides some relevant information about DuPont’s decision to break into three separate companies and compares it to General Electric’s similar move. However, it lacks in-depth analysis or exploration of the reasons behind this decision and its potential consequences. It also includes some irrelevant details such as text-to-speech technology and investor reactions without providing any significant insights.

Public Companies: DuPont (DD), General Electric (GE)

Key People: Ed Breen (CEO), Lori Koch (Chief Financial Officer), Larry Culp (CEO)

Financial Relevance: Yes

Financial Markets Impacted: DuPont’s stock market performance and investors’ reactions

Financial Rating Justification: The article discusses DuPont’s decision to break into three separate companies, which will impact their financial performance and the stock market value of each new company. It also mentions the positive reaction from investors and compares it to General Electric’s similar move.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no extreme event mentioned in the article.

www.marketwatch.com

www.marketwatch.com