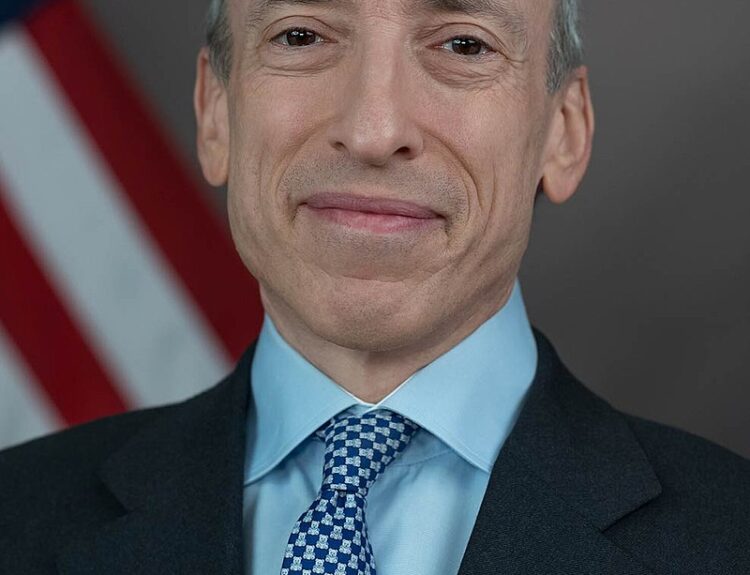

Ackman seeks to capitalize on his celebrity status by selling a new closed-end fund to investors.

- Bill Ackman is seeking to raise $25 billion by selling Pershing Square USA to investors.

- The fund will have a 2% annual management fee, higher than typical actively managed funds.

- Pershing Square Holdings, Ackman’s current investment vehicle, has returned 28% annually over the past five years.

- The new closed-end fund will invest in durable North American growth companies.

- Investors have the alternative of investing in Pershing Square Holdings, which trades at a 25% discount to its net asset value.

Bill Ackman, the CEO of Pershing Square Capital Management, is looking to raise $25 billion by selling a New York Stock Exchange–listed equity-oriented closed-end fund, Pershing Square USA, to investors. The fund will have a 2% annual management fee, which is higher than the typical fee for actively managed funds. Ackman’s current investment vehicle, Pershing Square Holdings, has performed well, returning 28% annually over the past five years. The new closed-end fund will focus on investing in durable North American growth companies. However, investors have the alternative of investing in Pershing Square Holdings, which trades at a 25% discount to its net asset value, making it a potentially more appealing option. It remains to be seen whether Ackman can successfully raise the targeted amount for the new fund in a market that has shown weak demand for actively managed funds.·

Factuality Level: 2

Factuality Justification: The article provides detailed information about Bill Ackman’s new closed-end fund and his investment strategies. However, it includes unnecessary background information about Ackman’s personal life, political views, and unrelated activities, which are not directly relevant to the main topic. The article also contains biased and opinionated statements, such as Ackman’s criticism of President Joe Biden and his reported leaning towards supporting Donald Trump, which detract from the overall factuality of the piece.·

Noise Level: 2

Noise Justification: The article provides detailed information about Bill Ackman’s new closed-end fund, his investment strategies, past performance, and future plans. It includes relevant financial details, market analysis, and potential challenges. However, it includes some irrelevant information about Ackman’s personal views and activities that are not directly related to the investment topic.·

Public Companies: Pershing Square Holdings (PSHZF)

Private Companies: Pershing Square Capital Management

Key People: Bill Ackman (Chief Executive Officer of Pershing Square Capital Management), Bryn Torkelson (President of Matisse Capital), Robert Willens (Tax Expert)

Financial Relevance: Yes

Financial Markets Impacted: Investors and financial markets

Financial Rating Justification: The article discusses Bill Ackman’s plan to sell a closed-end fund to investors, which will impact investors and potentially financial markets as they consider investing in the fund.·

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no mention of any extreme event in the article. The article primarily focuses on Bill Ackman’s plans to sell a closed-end fund and his investment strategies.·

www.marketwatch.com

www.marketwatch.com