Record highs fueled by Apple, Microsoft, Alphabet, and Meta’s gains mask losses in other sectors

- Record highs for S&P 500 and Nasdaq Composite driven by a few megacap stocks

- Apple, Microsoft, Alphabet, and Meta’s gains papered over losses in other sectors

- Only information technology and communications services sectors saw gains

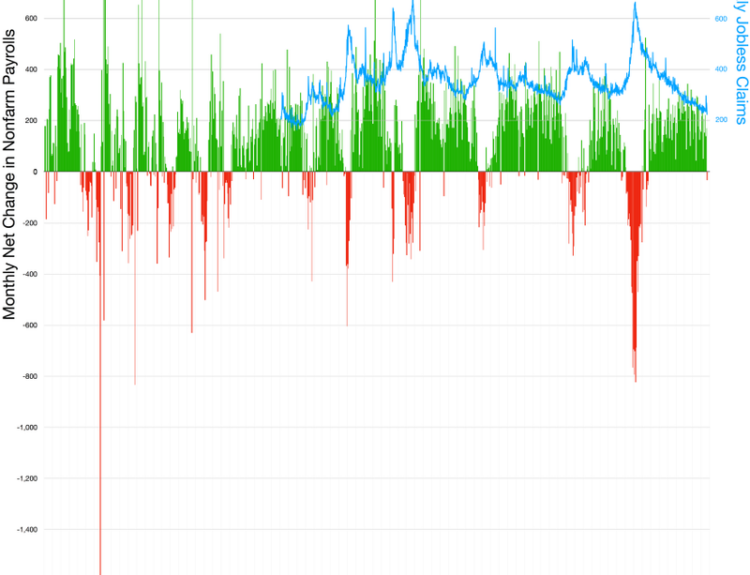

- Unusual divergence of NYSE stocks hitting new highs and lows

- Previous instances led to selloffs

- Concentrated market returns justified by strong fundamentals

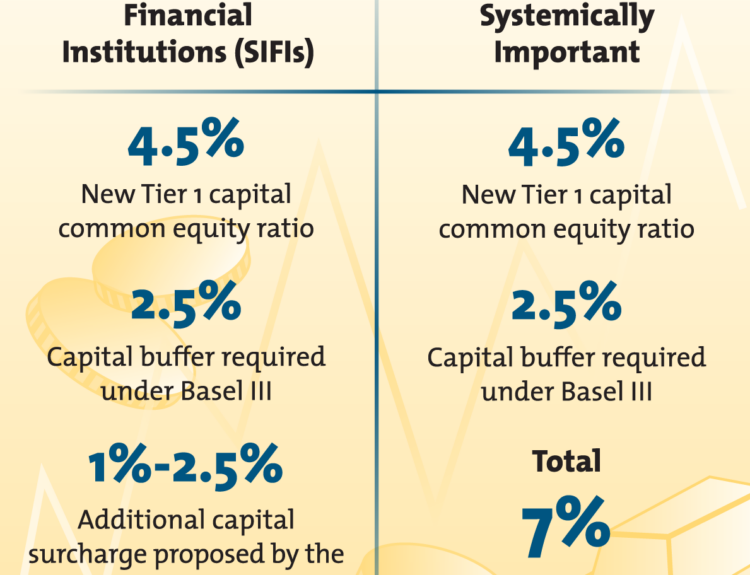

The S&P 500 and Nasdaq Composite reached record highs on Tuesday, but the gains were mainly driven by a few megacap stocks like Apple, Microsoft, Alphabet, and Meta. Only two sectors – information technology and communications services – saw gains, while most other stocks in the S&P 500 finished lower. This concentration has led some strategists to question if a pullback is overdue. Unusual divergences, such as more NYSE stocks hitting new lows than highs and falling volume outpacing rising volume, have occurred before market tops. In the past, these patterns didn’t always lead to selloffs, but they raise concerns about the narrow path to record highs. The three megacap stocks driving the index are Microsoft, Apple, and Nvidia, which together comprise over 20% of the S&P 500’s market cap.

Factuality Level: 8

Factuality Justification: The article provides accurate information about the recent record highs of the S&P 500 and Nasdaq Composite, mentions the role of a few megacap stocks in driving these gains, and discusses concerns about market concentration. It also includes data from experts and historical patterns to support its claims. However, it could be improved by providing more context on the CPI report’s impact on stocks and bonds.

Noise Level: 6

Noise Justification: The article provides some relevant information about market trends and indicators, but it also includes a significant amount of repetitive information and relies on popular narratives without questioning them. It could benefit from more in-depth analysis and evidence to support its claims.

Public Companies: Apple Inc. (AAPL), Microsoft Corp. (MSFT), Alphabet Inc. (GOOGL), Meta Platforms Inc. (META), Nvidia Corp. (NVDA)

Key People: Torsten Slok (Apollo’s data analyst), Grant Hawkridge (AllStarCharts analyst), Jason Goepfert (Founder of SentimenTrader), Todd Sohn (Strategas analyst)

Financial Relevance: Yes

Financial Markets Impacted: U.S. stock markets (S&P 500, Nasdaq Composite, NYSE)

Financial Rating Justification: The article discusses the financial performance of major U.S. stock indexes and individual companies like Apple, Microsoft, Alphabet, Meta Platforms, Nvidia, and their impact on market trends and potential pullbacks.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no extreme event mentioned in the article. The content discusses financial market trends and performance of specific stocks.

www.marketwatch.com

www.marketwatch.com