Discover how Susan Bao’s investment strategy helps her find winners and losers in the market

- Susan Bao, a portfolio manager at JPMorgan Asset Management, discusses her investment strategy

- She uses fundamental research to forecast future earnings and cash flows

- The strategy involves buying attractive stocks and shorting expensive ones

- Bao’s team is now focusing on AI winners in the electric and utility sectors

- They are also shorting fake data-center plays

- Bao believes it is now easier to find market losers due to higher interest rates

Susan Bao, a portfolio manager at JPMorgan Asset Management, has developed a successful investment strategy that makes it easier to identify market losers. Bao and her team use fundamental research to forecast future earnings and cash flows, which helps determine stock prices. They buy stocks that look attractive and short expensive ones. For example, they bought a basket of semiconductors before AI became popular, and they have been successful due to the growth possibilities in the industry. They also short hardware companies due to advances in cloud technology. Bao’s team is now focusing on AI winners in the electric and utility sectors, as well as data-center real estate investment plays. They have created a long/short basket of real data-center plays and are shorting fake data-center plays. Bao believes that it is now easier to find market losers due to higher interest rates and the end of free money. She also mentions that they are finding decent short ideas in every sector. Overall, Bao’s investment strategy has helped her identify winners and losers in the market.·

Factuality Level: 2

Factuality Justification: The article contains irrelevant information about a fund manager’s investment strategy and personal background, as well as details about specific stock holdings that are not directly related to the main topic of the article. It includes tangential information about the fund’s pair trades and specific companies being shorted, which do not contribute to the overall understanding of the market trends being discussed. The article lacks focus on the main topic of market performance and key asset trends, making it misleading and overly detailed.·

Noise Level: 2

Noise Justification: The article provides detailed information about the investment strategies of a senior portfolio manager at JPMorgan Asset Management, including insights into AI plays, shorting strategies, and market trends. It also includes information on stock performance, key asset performance, and market buzz. However, the article contains some irrelevant information such as random reads and unrelated news snippets.·

Public Companies: Micron Technology (MU), Nvidia (NVDA), Microsoft (MSFT), Amazon.com (AMZN), Apple (AAPL), Meta (META), Alphabet (GOOGL), Morgan Stanley (MS), American Express (AXP), Levi Strauss & Co. (LEVI), Walgreens Boots Alliance (WBA), Nike (NKE), CDK Global (CDK), Brookfield Business Partners (BBU), Faraday Future Intelligent Electric (FFIE), AMC Entertainment (AMC), Taiwan Semiconductor Manufacturing (TSM), Rivian Automotive (RIVN)

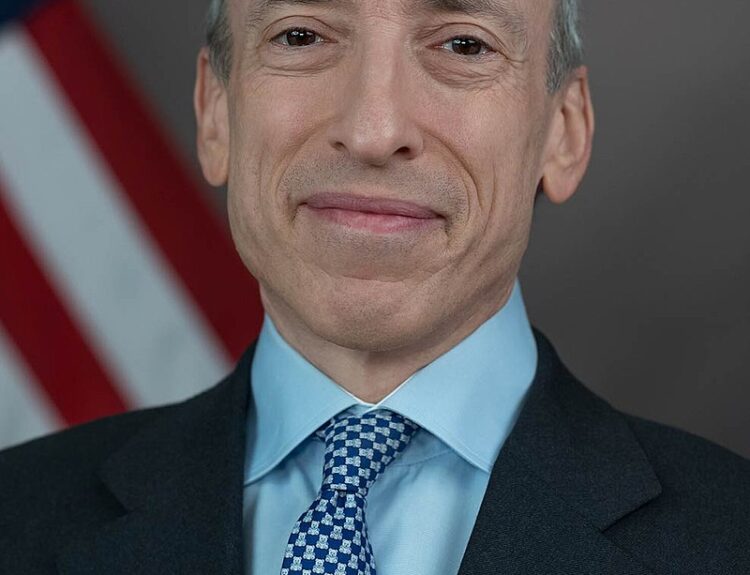

Key People: Susan Bao (Senior Portfolio Manager, U.S. Equity Group at JPMorgan Asset Management)

Financial Relevance: Yes

Financial Markets Impacted: The article discusses the performance of Micron Technology and its impact on the stock market. It also mentions the top holdings in JPMorgan’s U.S. large-cap core plus fund, which includes tech stocks like Microsoft, Nvidia, Amazon, Apple, and Alphabet. Additionally, the article discusses the strategy of shorting expensive stocks and buying more attractive ones, as well as the search for AI winners in electric and utility companies. Overall, the article pertains to financial topics and discusses events that impact financial markets and companies.

Financial Rating Justification: The article discusses the performance of Micron Technology and its impact on the stock market. It also mentions the top holdings in JPMorgan’s U.S. large-cap core plus fund, which includes tech stocks like Microsoft, Nvidia, Amazon, Apple, and Alphabet. Additionally, the article discusses the strategy of shorting expensive stocks and buying more attractive ones, as well as the search for AI winners in electric and utility companies. These topics are directly related to financial markets and companies.·

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: ·

www.marketwatch.com

www.marketwatch.com