Breaking the tradition of shutting down during bad weather

- Hong Kong Exchange considering allowing trades on stormy days

- Currently, the exchange shuts down during severe weather conditions

- Public consultation open until Jan. 26 for feedback on the proposal

- Extreme weather has caused 11 instances of market-wide trading suspensions since 2018

- Plan aims to improve stock-market liquidity and trading volumes in Hong Kong

Hong Kong Exchanges & Clearing, the operator of Hong Kong’s stock market, is seeking public feedback on a proposal to allow trading to continue during severe weather conditions. Currently, the exchange shuts down on stormy days, which has led to 11 instances of market-wide trading suspensions since 2018. The plan aims to improve stock-market liquidity and trading volumes in Hong Kong, where officials have formed a task force to address the issue. If approved, stormy-day trading could begin as early as July 2024.

Factuality Level: 8

Factuality Justification: The article provides factual information about Hong Kong’s stock market considering its history of shutting down on typhoon days and the proposal to allow trades in bad weather. It also mentions the number of instances of market-wide trading suspensions due to extreme weather conditions. The article includes information about Hong Kong’s efforts to improve stock-market liquidity and the operator’s plan to test sessions for severe-weather trading. The proposal’s timeline is also mentioned. Overall, the article provides objective information without any apparent bias or misleading information.

Noise Level: 7

Noise Justification: The article provides relevant information about the proposal to allow trades in bad weather in Hong Kong’s stock market. It mentions the current practice of shutting down the market during severe weather conditions and the impact it has had on trading volumes. The article also highlights the efforts to improve stock-market liquidity and the potential testing sessions to prepare for severe-weather trading. However, it lacks in-depth analysis, scientific rigor, and actionable insights. It mainly focuses on reporting the proposal and its timeline without providing much context or exploring the consequences of the decision.

Financial Relevance: Yes

Financial Markets Impacted: The article pertains to the Hong Kong stock market and its potential impact on trading volumes and stock-market liquidity.

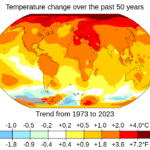

Presence Of Extreme Event: Yes

Nature Of Extreme Event: Natural Disaster

Impact Rating Of The Extreme Event: Minor

Rating Justification: The extreme event mentioned in the article is severe weather conditions, specifically typhoons and rainstorms, which have caused trading suspensions in the Hong Kong stock market. While the impact is relatively minor, with trading suspensions ranging from several hours to a full trading day, it is significant enough to prompt the proposal to allow trades to continue during severe weather conditions. This change could potentially improve stock-market liquidity and trading volumes in Hong Kong.

Public Companies: Hong Kong Exchanges & Clearing (HKEX)

Key People:

Reported publicly:

www.marketwatch.com

www.marketwatch.com