Accelerating inflation looks like a lesser risk than a weakening labor market

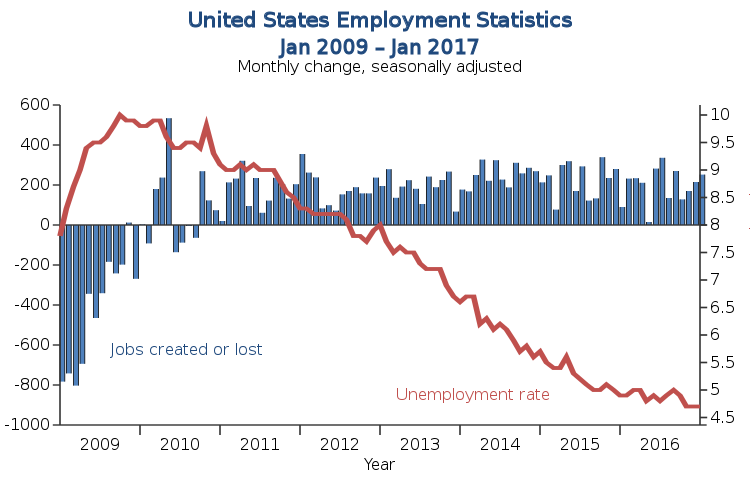

- Inflation has fallen from 4.3% to 2.6%

- Unemployment rate has risen to 4.1%

- Fed Chair Jerome Powell is reluctant to cut interest rates

The Federal Reserve pushed interest rates above 5% a year ago to achieve lower inflation and a cooler labor market. Inflation has fallen from 4.3% to an estimated 2.6% now, and the unemployment rate has risen to 4.1%. Despite this success, Fed Chair Jerome Powell is hesitant to cut interest rates. However, if the Fed trusted its own forecast, it would be comfortable cutting rates now. Waiting brings risks, such as a potential weakening labor market. The Fed should weigh these risks and actively debate the option of cutting rates at its upcoming meeting. While there are risks to cutting rates, a reacceleration of inflation seems unlikely. The shocks of recent years have caused temporary boosts to prices, but they can’t sustain inflation unless other conditions, like a tight labor market, are in place. With vacancies falling and unemployment rising, the labor market is no longer tight. The Fed should consider cutting rates now to avoid potential risks in the future.·

Factuality Level: 3

Factuality Justification: The article provides a mix of relevant information about the Federal Reserve’s stance on interest rates, historical context, and potential risks of cutting rates. However, it contains some tangential details and opinions presented as facts, such as the discussion on the impact of the upcoming election on the Fed’s decision-making process. The article also lacks depth in analyzing some economic indicators and relies heavily on speculative statements.·

Noise Level: 3

Noise Justification: The article provides a detailed analysis of the Federal Reserve’s decision-making process regarding interest rates, including historical context, risks of cutting rates, and potential consequences. It offers a balanced view of the situation and supports its claims with data and examples. However, the article could benefit from more diverse perspectives and a deeper exploration of potential outcomes.·

Private Companies: Goldman Sachs

Key People: Jerome Powell (Fed Chair), John Williams (New York Fed President), Chris Waller (Fed Governor), Jan Hatzius (Chief Economist at Goldman Sachs)

Financial Relevance: Yes

Financial Markets Impacted: Financial markets may be impacted by the Fed’s decision on whether or not to cut interest rates.

Financial Rating Justification: The article discusses the Federal Reserve’s decision on whether or not to cut interest rates, which can have a significant impact on financial markets and companies.·

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: ·

www.wsj.com

www.wsj.com