Finnish Utility Fortum Streamlines Operations with €875M Sale

- Finnish utility Fortum sells recycling-and-waste business to Summa Equity for €800 million ($875 million)

- Sale allows Fortum to focus on clean power generation

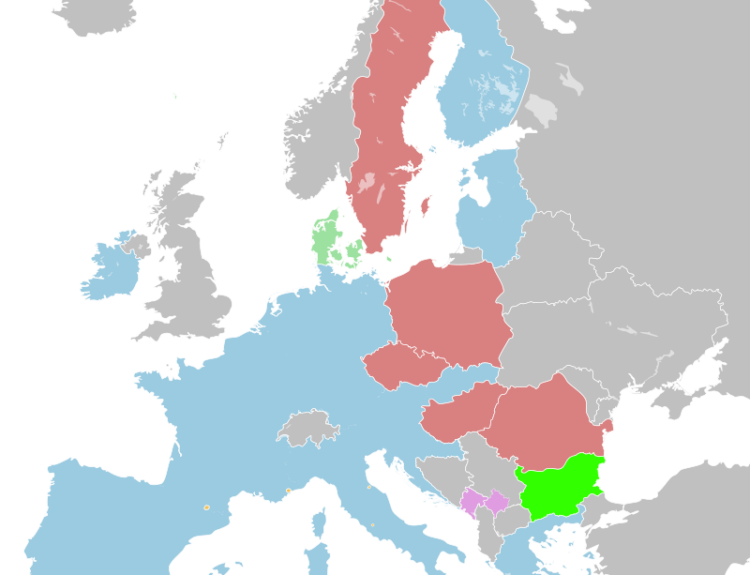

- Recycling and waste management businesses in Finland, Sweden, Denmark, and Norway included in the deal

- Strategic review of turbine and generator services, battery-recycling business, biobased solutions, and UK waste-to-energy business ongoing

Finnish utility company Fortum has agreed to sell its recycling and waste management business to investment firm Summa Equity for €800 million ($875.2 million). This move allows the company to focus on its core operations in clean power generation while generating a tax-exempt capital gain of around €110 million. The sale includes municipal and industrial waste management, plastics, metals, ash, slag, and hazardous waste treatment, as well as recycling services located in Finland, Sweden, Denmark, and Norway. Fortum is also conducting a strategic review of its turbine and generator services, battery-recycling business, biobased solutions businesses, and UK waste-to-energy business. The net assets of these remaining businesses total €90 million. The sale to Summa Equity’s NG Group portfolio company is expected to be completed in Q4 2023, subject to closing conditions.

Factuality Level: 10

Factuality Justification: The article provides accurate and objective information about Fortum’s decision to sell its recycling-and-waste business to Summa Equity for EUR800 million, the businesses involved in the sale, the reason behind the sale, and the expected completion timeline. It also mentions the strategic review of other related businesses and their net assets.

Noise Level: 3

Noise Justification: The article provides relevant information about a business transaction and the strategic review of Fortum’s operations without any irrelevant or misleading content. It also includes specific details about the sale and the businesses involved. However, it does not delve into long-term trends or possibilities, hold powerful people accountable, explore consequences, provide intellectual honesty, stay on topic, support claims with evidence, or offer actionable insights.

Public Companies: Fortum (N/A)

Private Companies: Summa Equity

Key People:

Financial Relevance: Yes

Financial Markets Impacted: Fortum and Summa Equity

Financial Rating Justification: The article discusses a business sale between Fortum and Summa Equity, which has financial implications for both companies and could potentially impact their stock prices or operations in the market.

Presence Of Extreme Event: No

Nature Of Extreme Event: Other

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no extreme event mentioned in the article.

www.marketwatch.com

www.marketwatch.com