Investors Recalibrate Expectations Amid Economic Updates

- Materials producers face challenges as U.S. dollar rises

- Federal Reserve Chair Jerome Powell reassures on economy’s solid shape

- ECB sees inflation settling at target, to consider policy adjustments

The materials sector is facing challenges as the U.S. dollar rises, following Federal Reserve Chair Jerome Powell’s reassurances about the economy’s solid shape and the European Central Bank’s confidence in inflation settling at its target. Investors are expected to recalibrate their rate expectations based on upcoming employment data, according to J.D. Joyce, president of Houston financial advisory Joyce Wealth Management.

Factuality Level: 8

Factuality Justification: The article provides accurate information about the U.S. central bank’s stance on interest rates, quotes from Federal Reserve Chair Jerome Powell and European Central Bank President Christine Lagarde, and discusses the importance of employment data in decision-making. It is well-structured and relevant to the topic.

Noise Level: 7

Noise Justification: The article provides relevant information about the U.S. central bank’s stance on interest rates and the European Central Bank’s view on inflation, but it lacks in-depth analysis or actionable insights for readers.

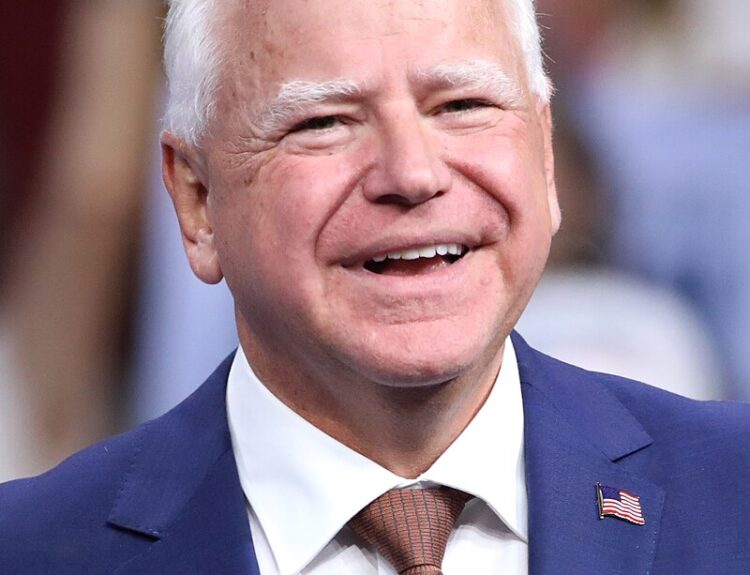

Key People: Jerome Powell (Chair of the Federal Reserve), J.D. Joyce (President of Joyce Wealth Management), Christine Lagarde (President of the European Central Bank)

Financial Relevance: Yes

Financial Markets Impacted: U.S. dollar, metals and raw materials producers

Financial Rating Justification: The article discusses the impact of the U.S. central bank’s stance on interest rates on financial markets such as the U.S. dollar and the performance of metals and raw materials producers, as well as the European Central Bank’s view on inflation.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no mention of an extreme event in the text and it does not meet the criteria for being within the last 48 hours.

Move Size: No market move size mentioned.

Sector: All

Direction: Up

Magnitude: Medium

Affected Instruments: Stocks, Bonds

www.marketwatch.com

www.marketwatch.com