Savers beware: Your high-yield CD might not last as long as you think!

- Banks are recalling high-yielding CDs before maturity as interest rates fall.

- Callable CDs offer higher rates but come with the risk of being called early.

- Investors should understand the call-protection period and call schedule to avoid surprises.

- The era of 5% cash returns is ending, with current rates dropping below 5%.

- Callable CDs are more attractive short-term but may underperform noncallable ones in the long run.

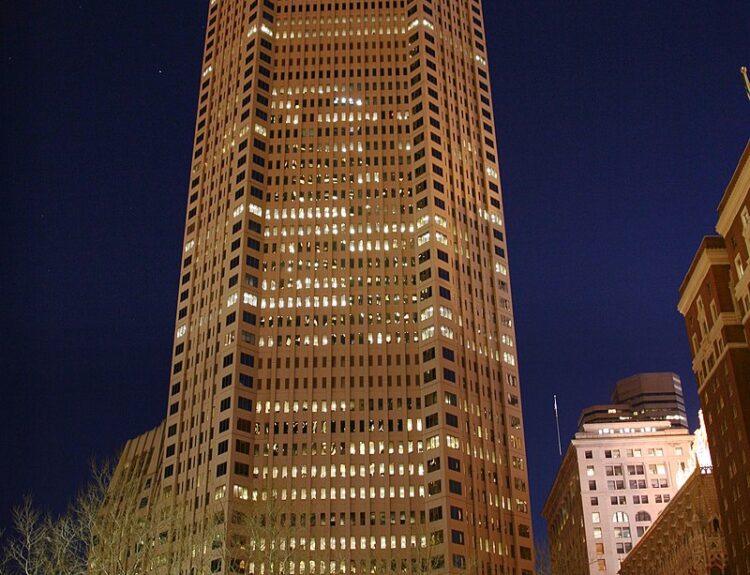

As interest rates decline, many banks are recalling high-yielding certificates of deposit (CDs) before their maturity dates. This move is aimed at saving on interest payments, leaving investors with lower returns than expected. Callable CDs, which offer higher rates, come with the risk of being called back early, especially as rates continue to fall. Investors need to be aware of the call-protection period and the call schedule associated with their callable CDs to avoid unexpected surprises and make informed reinvestment decisions.nnBefore the Federal Reserve began cutting rates in September, banks were offering CDs with attractive yields exceeding 5%. However, these high-yielding CDs often included features that allowed banks to ‘call’ them back before maturity, returning the cash along with accrued interest. This feature was largely overlooked when rates were rising, as banks had no incentive to call their CDs when they could borrow at even higher rates.nnNow, major banks like JPMorgan Chase and U.S. Bank are increasingly calling back these high-yielding CDs to reduce their interest expenses. Many everyday investors may have purchased callable CDs without fully understanding the implications, leading to confusion when their CDs were unexpectedly called. As one investor expressed on Reddit, they were surprised to find a large deposit in their brokerage account after their 5.4% CD was called early.nnWith the current highest offer for a 12-month CD at just 4.8%, investors who had their CDs called now face the challenge of reinvesting their cash at lower rates. Callable CDs may seem appealing in the short term, but they could underperform noncallable CDs in the long run if interest rates continue to decline. For instance, a $10,000 12-month CD with a 5% yield that gets called two months early could yield about $35 less in total interest compared to a 4.5% noncallable CD purchased at the same time.nnWhile most CDs are not callable, those that are typically offer higher rates—around 0.4% more than noncallable CDs of the same duration. These callable CDs are often sold through brokerages, and a significant portion of CDs traded through platforms like Fidelity are callable. As banks sell CDs through brokers, they can adjust interest rates on large deposits without needing to communicate with individual customers.nnIf you discover that you own a callable CD, it may be tempting to sell it to reinvest before rates drop further. However, analysts generally advise against this, as early withdrawals often incur penalties that can significantly reduce returns. If your CD is called, you will at least receive your principal back along with accrued interest.nnFor those holding callable CDs, it’s essential to keep track of the call-protection period, which is the initial timeframe during which the bank cannot call your CD. This period typically lasts from six months to a year. Additionally, understanding the call schedule—how often the bank can call the deposit—can help you assess your options and make timely decisions.nnAfter a CD is called, the next steps depend on your brokerage’s settings. One option is to have the funds transferred to a money-market account, which can still provide competitive returns on uninvested cash. With interest rates falling, it’s crucial to quickly decide where to reinvest your funds, whether in noncallable CDs, Treasurys, or high-yield savings accounts. However, be prepared to reinvest at lower rates unless you are willing to consider riskier investments like corporate or municipal bonds. As experts note, the days of risk-free 5% returns are over.·

Factuality Level: 8

Factuality Justification: The article provides a detailed and informative overview of callable CDs and the implications of banks calling them back before maturity. It includes relevant statistics and expert opinions, which enhance its credibility. However, there are minor instances of opinion presented as fact, particularly in the interpretation of investor reactions and the potential outcomes of callable CDs, which slightly detracts from its overall objectivity.·

Noise Level: 8

Noise Justification: The article provides a detailed analysis of callable CDs, their risks, and the implications of falling interest rates. It includes expert opinions, data, and actionable insights for investors, maintaining focus on the topic without irrelevant information. However, it could benefit from a deeper exploration of long-term trends and consequences for investors.·

Public Companies: JPMorgan Chase (JPM), U.S. Bank (USB), Charles Schwab (SCHW), Fidelity (N/A), CorePoint (N/A)

Key People: Kathy Jones (Chief Fixed-Income Strategist), Neil Stanley (CEO)

Financial Relevance: Yes

Financial Markets Impacted: The article discusses the impact of falling interest rates on callable CDs, affecting banks and investors’ returns.

Financial Rating Justification: The article addresses financial topics related to certificates of deposit (CDs), interest rates, and the implications for investors and banks, making it highly relevant to financial discussions.·

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: The article discusses the impact of falling interest rates on callable CDs and does not report on any extreme event occurring in the last 48 hours.·

Move Size: No market move size mentioned.

Sector: All

Direction: Down

Magnitude: Large

Affected Instruments: Bonds

www.wsj.com

www.wsj.com