Central Banks Navigate Inflation and Economic Uncertainty in Eurozone

- Eurozone inflation falls below ECB’s target for the first time in over three years

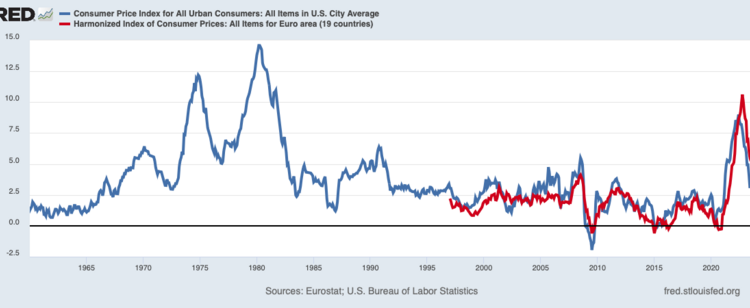

- Consumer prices increased by 1.8% on year in September across the eurozone

- Inflation could rise again in the year’s final months due to base effects in energy

- ECB President Christine Lagarde suggests lowering inflation forecasts and cutting interest rates

- Some eurozone members experienced even lower inflation, hitting just above 0% in Ireland and below 1% in Italy, Finland, Lithuania, Luxembourg, and Slovenia

- Weaker inflation comes amid slowing growth in the eurozone economy

- Business surveys suggest manufacturing sector remains sluggish and services boom fades rapidly

- Germany’s economy faces risk of recession after unexpected contraction in Q2

- ECB officials must address faltering economic recovery and low consumer confidence

Eurozone inflation has fallen below the European Central Bank’s (ECB) target for the first time since June 2021, indicating a potential end to the struggle with high inflation. Consumer prices increased by 1.8% on an annual basis in September across the 20 nations that make up the eurozone. This development could lead to lower interest rates and easing of borrowing costs for investment and consumer spending. However, inflation might rise again in the final months of the year due to base effects in energy prices. ECB President Christine Lagarde mentioned that the central bank will consider these factors at its upcoming policy meeting. Some eurozone members experienced even lower inflation rates, with Ireland seeing just above 0% and Italy, Finland, Lithuania, Luxembourg, and Slovenia below 1%. The slowing economy raises concerns about job market stability. Business surveys indicate that the manufacturing sector remains sluggish, while the services boom has faded rapidly. Germany’s economy faces a recession risk after contracting in Q2. ECB officials must address these challenges and consumer confidence issues.

Factuality Level: 8

Factuality Justification: The article provides accurate and objective information about Eurozone inflation rates, central bank policies, and their impact on economies. It cites relevant sources and experts’ opinions to support its claims, and does not include sensationalism or personal perspectives.

Noise Level: 3

Noise Justification: The article provides relevant information about Eurozone inflation and its impact on central banks’ policies, as well as the potential effects on the economy. It also offers insights from economists and analysts. However, it does not contain any misleading or irrelevant information, nor does it reinforce popular narratives without questioning them. The article stays on topic and supports its claims with evidence and data.

Public Companies: Deutsche Bank (DB), ECB (N/A), Bank of England (N/A), Swiss National Bank (N/A)

Private Companies: Bertrandt,Pantheon Macroeconomics,Ballinger Group

Key People: Christine Lagarde (President of the ECB), Claus Vistesen (Economist at Pantheon Macroeconomics), Melanie Debono (Economist at Pantheon Macroeconomics), Kyle Chapman (Foreign-currency analyst with Ballinger Group)

Financial Relevance: Yes

Financial Markets Impacted: ECB, U.S. Federal Reserve, Bank of England, Swiss National Bank, Eurozone economies (France, Italy, Spain, Germany), manufacturing sector, consumer confidence

Financial Rating Justification: The article discusses the decrease in inflation rates in the Eurozone and its impact on central banks’ monetary policies, as well as its potential effects on financial markets and various European economies. It mentions interest rate changes by central banks like ECB, US Federal Reserve, Bank of England, and Swiss National Bank, and how these changes may affect investment and consumer spending. Additionally, it highlights the impact of inflation on the manufacturing sector and consumer confidence in countries such as Germany and France.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no extreme event mentioned in the article and it mainly discusses inflation and economic indicators.

Move Size: No market move size mentioned.

Sector: All

Direction: Down

Magnitude: Large

Affected Instruments: Stocks, Bonds

www.marketwatch.com

www.marketwatch.com