Investors Shift Away from Tech Amid Middle East Conflict

- Nvidia stock falls amid Middle East tensions

- Investors flee tech for safer sectors like utilities

- Nvidia pauses development of server configuration for Blackwell GPUs

- Ming-Chi Kuo’s report on supply chain changes

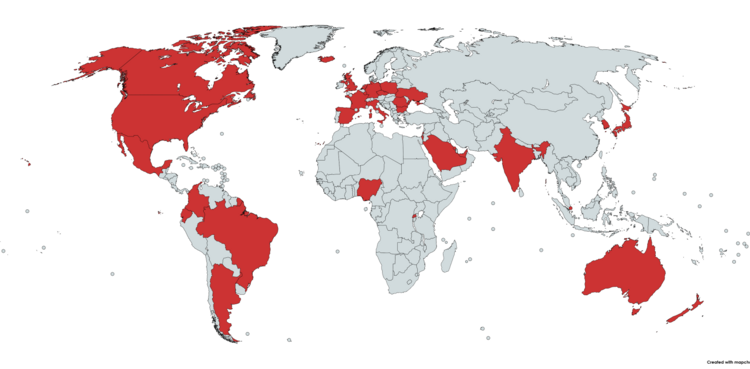

Nvidia’s stock faced a setback as investors grew concerned about the escalating tensions between Israel and Iran. The chipmaker’s shares dropped 0.6% to $116.25, while the S&P 500 futures only declined by 0.1%. As the market worried about the impact of Iran’s attack on Israel, oil prices surged and U.S. stocks fell. Nvidia, Apple, and Microsoft were among the hardest hit tech companies, with investors seeking refuge in safer sectors like utilities. The potential for further conflict could affect stock performance. Additionally, a report from analyst Ming-Chi Kuo suggested that Nvidia has paused development of one server configuration for its Blackwell GPUs, which may cause confusion in the supply chain.

Factuality Level: 8

Factuality Justification: The article provides accurate information about Nvidia’s stock performance in relation to the market trends and includes a relevant report from an analyst regarding the company’s product development decisions.

Noise Level: 3

Noise Justification: The article provides relevant information about Nvidia’s stock performance in relation to geopolitical events and a specific company decision, but it lacks in-depth analysis or exploration of long-term trends or possibilities. It also does not hold powerful people accountable or explore consequences on those who bear the risks.

Public Companies: Nvidia (NVDA), Apple (AAPL), Microsoft (MSFT), Advanced Micro Devices (AMD), Broadcom (AVGO), Qualcomm (QCOM)

Key People: Ming-Chi Kuo (Analyst at TF International Securities)

Financial Relevance: Yes

Financial Markets Impacted: Nvidia, Apple, Microsoft, Advanced Micro Devices, Broadcom, Qualcomm

Financial Rating Justification: The article discusses the impact of geopolitical events on Nvidia’s stock and other tech companies’ stocks, as well as a potential change in Nvidia’s product development plans. This directly pertains to financial topics such as stock prices and market performance.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no extreme event mentioned in the text and it’s not the main topic. The article discusses Nvidia stock performance due to geopolitical tensions and a company decision regarding its product development.

Move Size: The market move size mentioned in this article is a 0.6% fall in Nvidia’s stock price to $116.25.

Sector: Technology

Direction: Down

Magnitude: Medium

Affected Instruments: Stocks

www.barrons.com

www.barrons.com