Slower-than-expected EV Sales and Challenges Ahead

- Toyota delays U.S. production of an all-electric three-row SUV by several months

- EV sales growth affecting auto makers’ production plans

- Americans bought about 785,000 all-electric vehicles in August, up 7% year over year

- Toyota sold 710,060 electrified vehicles in the U.S., up 56% year over year (mostly mild hybrids)

- All-electric vehicles still cost significantly more than average car

- Industry slow to roll out affordable battery-electric models

- EV incentives account for 13.3% of transaction price, up 60% year over year

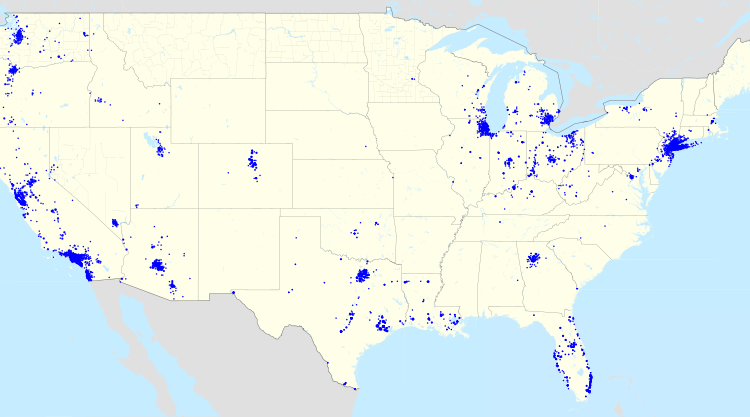

- Limited public charging infrastructure in the U.S.

- Tesla’s success due to convenient charging network and affordability

- Auto makers need to address consumer demand for good deals and convenience

Toyota has delayed the production of an all-electric three-row SUV for the U.S. market, citing design changes as the reason. However, this is another example of slower-than-expected electric vehicle sales affecting automakers’ production plans. Despite increased sales, EVs still face challenges such as higher upfront costs and limited charging infrastructure. Toyota, the largest seller of mild hybrids, has sold 22,000 all-electric vehicles and 41,000 plug-in hybrids in the U.S. so far this year. The industry needs to address consumer demand for good deals and convenience as they roll out new EVs.

Factuality Level: 8

Factuality Justification: The article provides accurate and objective information on the slow growth of EV sales in the U.S., factors affecting their demand such as higher prices and limited charging infrastructure, and mentions Toyota’s delayed production plans for an all-electric SUV. It also discusses the role of incentives and Tesla’s success due to convenience. The information is relevant and well-researched.

Noise Level: 7

Noise Justification: The article provides relevant information on the slow growth of electric vehicle sales in the U.S., factors affecting their popularity such as higher prices and limited charging infrastructure, and mentions Toyota’s delayed production plans for an all-electric SUV. However, it lacks a more in-depth analysis or exploration of potential solutions to these issues and does not offer significant new insights beyond what is already known.

Public Companies: Toyota (TM), Tesla (TSLA)

Key People:

Financial Relevance: Yes

Financial Markets Impacted: Yes

Financial Rating Justification: The article discusses the slower-than-expected growth of electric vehicle sales, impacting Toyota’s production plans and affecting its stock prices. It also mentions the influence of incentives on sales and the role of charging infrastructure in the market.

Presence Of Extreme Event: No

Nature Of Extreme Event: Other

Impact Rating Of The Extreme Event: Minor

Extreme Rating Justification: The article discusses the slower-than-expected growth of electric vehicle sales and production delays, but it does not mention an extreme event. The impact is considered minor as it mainly focuses on the reasons behind these issues such as higher prices, lack of charging infrastructure, and auto makers’ response to consumer preferences.

Move Size: No market move size mentioned.

Sector: Automotive

Direction: Down

Magnitude: Small

Affected Instruments: Stocks

www.barrons.com

www.barrons.com