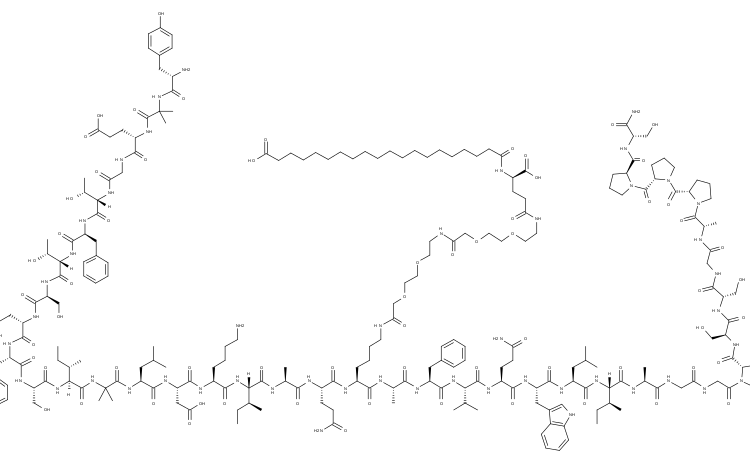

Pharmaceutical Company Acquires Injection for Severe Growth Deficiency Treatment

- Eton Pharmaceuticals shares reach 52-week high

- Acquisition of Increlex mecasermin injection from Ipsen

- Expected to close near year-end 2024

- Increlex used for severe primary insulin-like growth factor 1 deficiency treatment

- Approved in 40 territories, including the U.S. and EU

- Eton to commercialize product in U.S., Ipsen in transition period outside U.S.

Eton Pharmaceuticals has seen its shares reach a 52-week high following the acquisition of Increlex mecasermin injection from Ipsen. The deal, expected to close by year-end 2024, will see Eton immediately commercialize the product in the U.S., while Ipsen handles distribution during a six-month transition period outside the U.S. The treatment is used for severe primary insulin-like growth factor 1 deficiency and approved in 40 territories, including the U.S. and EU. Financing includes cash on hand and an expanded credit facility with SWK Holdings.

Factuality Level: 10

Factuality Justification: The article provides accurate and relevant information about the acquisition of Increlex mecasermin injection by Eton Pharmaceuticals from Ipsen, details about the product, its usage, territories it is approved in, and the financing of the transaction. It also mentions the timeline for commercialization and distribution. No bias or personal perspective is presented as a universally accepted truth.

Noise Level: 1

Noise Justification: The article provides relevant information about a specific pharmaceutical acquisition and its impact on the involved companies without any unnecessary or irrelevant content.

Public Companies: Eton Pharmaceuticals (ETON)

Private Companies: Ipsen,SWK Holdings

Key People: Chris Wack (Author)

Financial Relevance: Yes

Financial Markets Impacted: Yes

Financial Rating Justification: The article discusses a pharmaceutical company’s acquisition, which impacts the stock price of Eton Pharmaceuticals and involves financing through cash on hand and an expansion of its existing credit facility with SWK Holdings. This is relevant to financial topics and has an impact on the financial markets as it affects the company’s value and operations.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: No extreme event or crisis is mentioned in the article.

Move Size: The market move size mentioned in this article is a 10% increase in the stock price of Eton Pharmaceuticals, bringing it to $6.51 per share.

Sector: Healthcare

Direction: Up

Magnitude: Large

Affected Instruments: Stocks

www.marketwatch.com

www.marketwatch.com