Uncover the driving forces behind gold’s remarkable rise and what it means for your investments.

- Gold has reached record highs, hitting $2,695 an ounce on September 26.

- Gold’s year-to-date return of 28% outperforms the S&P 500’s 21% gain.

- Hedge funds are more bullish on gold than they have been since the mid-1980s.

- Central banks, particularly in China and India, have significantly increased gold purchases.

- Gold’s rise is influenced by various factors including interest rates, geopolitical instability, and inflation concerns.

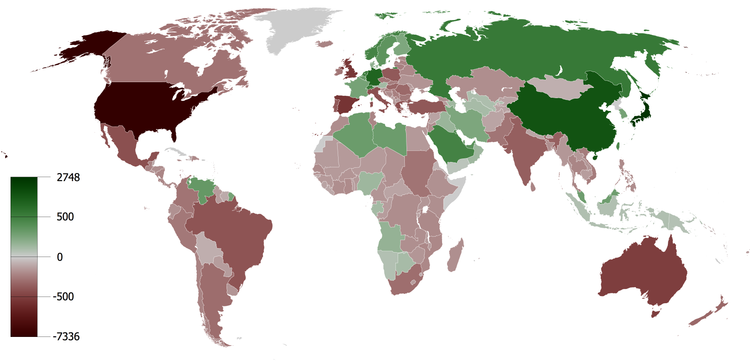

Gold is shining brightly this year, achieving remarkable success by surpassing stock market performance. As of September 26, gold prices reached an impressive $2,695 per ounce, marking 40 record highs this year alone. This surge is largely attributed to geopolitical tensions, such as the recent attack by Iran on Israel, which has contributed to a 28% increase in gold’s value, outpacing the S&P 500’s 21% gain. Hedge funds are showing unprecedented optimism towards gold, with bullish sentiment at its highest since the mid-1980s, according to Bespoke Investment Group’s analysis of futures market data. Major financial institutions like Bank of America and Citigroup predict that gold could reach $3,000 per ounce next year, representing an 11% increase from current prices. nnThe reasons behind gold’s ascent are varied and complex. Some attribute it to falling interest rates, which typically make gold more attractive as bond yields decline. However, the relationship between gold prices and interest rates is not straightforward. Historical data shows that while gold prices surged during periods of high inflation in the 1970s, they also fell when inflation and interest rates began to decrease in the early 1980s. Recent trends indicate that gold has rallied even when interest rates were higher, suggesting that other factors are at play. nnCentral bank purchases have also played a significant role in gold’s rise. Countries like China, India, and Poland have collectively bought over 1,000 metric tons of gold in recent years, accounting for a substantial portion of global demand. However, recent data shows a slowdown in these purchases, with central banks acquiring only 183 metric tons in the second quarter of 2023, down from 300 metric tons in the first quarter. nnRetail investors are also becoming more active in the gold market, particularly through exchange-traded funds (ETFs). After a period of outflows, gold ETF holdings have started to increase again, signaling renewed interest from Western investors. nnLooking ahead, some analysts believe that gold will continue to perform well as the U.S. faces significant fiscal challenges, including a national debt exceeding 120% of GDP. This situation could lead to a depreciation of the dollar, prompting more investors to turn to gold as a hedge against inflation. nnInvestors have various options for gaining exposure to gold, including physical bullion, mining stocks, and ETFs. While bullion offers a tangible asset, it comes with storage and selling challenges. Mining stocks can be volatile and may not always reflect gold price movements. ETFs, such as SPDR Gold Shares and iShares Gold Trust, provide a more straightforward way to invest in gold without the hassles of physical ownership. nnUltimately, how much gold to include in an investment portfolio depends on individual risk tolerance and investment strategy. Many financial advisors recommend keeping gold allocations below 15%. It’s important to remember that while gold can serve as a hedge against economic uncertainty, its price movements are often influenced by negative market sentiment. As such, maintaining a small allocation to gold can be a prudent strategy for investors looking to diversify their portfolios.·

Factuality Level: 7

Factuality Justification: The article provides a detailed analysis of the factors influencing gold prices, supported by data and expert opinions. However, it includes some speculative elements and opinions that could be perceived as biased, particularly regarding the future of gold prices and the implications of geopolitical events. While it presents a range of perspectives, the overall tone may lean towards sensationalism in discussing potential future gains.·

Noise Level: 8

Noise Justification: The article provides a thorough analysis of the factors influencing gold prices, including interest rates, central bank purchases, and geopolitical events. It references studies and data to support its claims, demonstrating scientific rigor and intellectual honesty. The article stays on topic and offers actionable insights for investors considering gold as part of their portfolio. However, it could improve by holding powerful entities more accountable and exploring the consequences of their decisions.·

Public Companies: Bank of America (BAC), Citigroup (C), Pimco (N/A), Costco Wholesale (COST), SPDR Gold Shares (GLD), iShares Gold Trust (IAU)

Key People: Imaru Casanova (Portfolio Manager), Arnold Van Den Berg (Founder of Century Management), Greg Sharenow (Portfolio Manager at Pimco), Martin Murenbeeld (Editor of Capitalight Research’s Gold Monitor)

Financial Relevance: Yes

Financial Markets Impacted: Yes

Financial Rating Justification: The article discusses the rise in gold prices, which is a significant financial topic. It mentions various factors influencing gold’s performance, including geopolitical events, interest rates, and central bank purchases. The impact on financial markets is evident as gold has outperformed stocks, and firms like Bank of America and Citigroup predict further gains, indicating a direct influence on investment strategies and market dynamics.·

Presence Of Extreme Event: Yes

Nature Of Extreme Event: Armed Conflicts and Wars

Impact Rating Of The Extreme Event: Moderate

Extreme Rating Justification: The article discusses the recent missile attacks by Iran on Israel, which is a significant geopolitical event that can have implications for global markets and investor behavior. The impact is rated as moderate due to the potential for economic consequences and increased instability, but there are no immediate reports of casualties or widespread destruction.·

Move Size: 28% year-to-date return

Sector: Commodities

Direction: Up

Magnitude: Large

Affected Instruments: Stocks, ETFs

www.marketwatch.com

www.marketwatch.com