Despite recent underperformance, historical trends and AI excitement may boost U.S. equities.

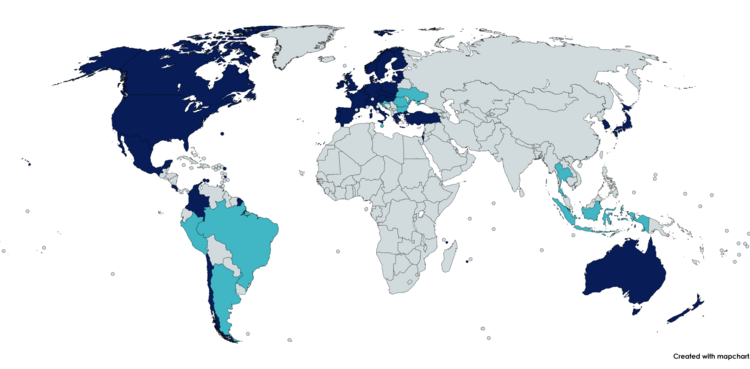

- U.S. stock market has underperformed compared to global markets since mid-June.

- Technology stocks in the U.S. have lagged behind, impacting overall market performance.

- Low exposure to financial stocks in the U.S. market compared to international markets.

- Depreciation of the U.S. dollar has boosted returns for foreign equities.

- Surge in Chinese shares has contributed to U.S. market underperformance.

- Analyst predicts U.S. market will reclaim dominance due to historical trends during Fed easing cycles.

- Investor enthusiasm for AI could lead to a stock market bubble, benefiting U.S. equities.

As we approach jobs Friday, the nonfarm payrolls report is once again a key economic indicator, signaling a return to normalcy for traders. However, the U.S. stock market has been experiencing a rare period of underperformance compared to global markets. Hubert de Barochez, a senior markets economist at Capital Economics, notes that since mid-June, the MSCI USA index has returned less than 5%, significantly trailing behind the rest of the world. nnDe Barochez identifies four main reasons for this trend. Firstly, the U.S. technology sector, which holds a substantial share of the market, has struggled. Although there has been a slight recovery, the overall decline in tech stocks has been sharper in the U.S. than elsewhere. Concerns over economic slowdowns have raised doubts about the sustainability of earnings growth for these companies, many of which were previously ‘priced for perfection.’ nnSecondly, the U.S. market’s low exposure to financial stocks has hindered performance. Financials represent only 13% of the U.S. index, compared to 22% in international markets, where a steepening yield curve has improved banks’ profit margins. nnThe third factor is the depreciation of the U.S. dollar, which has fallen over 3% since mid-June, enhancing returns for foreign equities. For instance, the yen’s rise against the dollar has turned a small drop in Japanese shares into a notable gain in dollar terms. nnLastly, the recent surge in Chinese shares, driven by significant stimulus from Beijing, has also played a role in the U.S. market’s relative underperformance. Despite these challenges, de Barochez remains optimistic, suggesting that the U.S. market is likely to regain its lead, as historical patterns during Federal Reserve easing cycles typically favor U.S. equities. nnMoreover, he believes that growing investor enthusiasm for AI could lead to a stock market bubble, similar to the dotcom era, potentially benefiting U.S. stocks disproportionately. However, he warns that a potential burst of this AI bubble in 2026 could negatively impact U.S. equities. nnAs the market awaits the September nonfarm payrolls report, which is expected to show a net addition of 150,000 jobs, investors are keeping a close eye on economic indicators and market trends.·

Factuality Level: 6

Factuality Justification: The article provides a mix of factual information and analysis regarding the U.S. stock market and economic indicators. However, it includes some speculative statements about future market performance and potential bubbles, which may not be universally accepted as fact. Additionally, there are instances of opinion presented as analysis, which detracts from its overall objectivity.·

Noise Level: 7

Noise Justification: The article provides a detailed analysis of the current state of the U.S. stock market, including specific data and expert opinions. It discusses various factors affecting market performance and offers insights into potential future trends, particularly regarding AI and its impact on the economy. However, it includes some filler content and tangential information that detracts from its overall focus.·

Public Companies: Nvidia (NVDA), Tesla (TSLA), NIO (NIO), GameStop (GME), Palantir Technologies (PLTR), Amazon.com (AMZN), Apple (AAPL), Alibaba (BABA), Taiwan Semiconductor Manufacturing (TSM), Spirit Airlines (SAVE), Rivian Automotive (RIVN)

Key People: Hubert de Barochez (Senior Markets Economist at Capital Economics), John Williams (New York Fed President), Austan Goolsbee (Chicago Fed President), Mark Newton (Head of Technical Strategy at Fundstrat)

Financial Relevance: Yes

Financial Markets Impacted: Yes

Financial Rating Justification: The article discusses various financial topics including the performance of the U.S. stock market, the impact of inflation, and the nonfarm payrolls report. It highlights how the U.S. market has underperformed compared to global indices and the reasons behind this, such as the lag in technology stocks and the low exposure to financial stocks. Additionally, it mentions the impact of currency depreciation and the performance of Chinese stocks on U.S. markets. The article also touches on specific companies like Rivian Automotive and Spirit Airlines, indicating their stock performance and market reactions.·

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: The article discusses economic trends and stock market performance but does not mention any extreme events that occurred in the last 48 hours.·

Move Size: No market move size mentioned.

Sector: All

Direction: Down

Magnitude: Medium

Affected Instruments: Stocks

www.marketwatch.com

www.marketwatch.com