Analysts see potential for AMC Entertainment to surpass prepandemic levels despite attendance not fully recovering

- B. Riley Securities raises AMC’s revenue and Ebitda estimates

- AMC Entertainment Holdings Q3 revenue estimate increased to $1.315 billion from $1.260 billion

- Adjusted Ebitda estimate lifted to $172 million from $135 million

- Domestic box-office revenues at $2.66 billion in Q3, up 95% compared to prepandemic levels

- Imax Corp. is B. Riley’s top sector pick for 2025

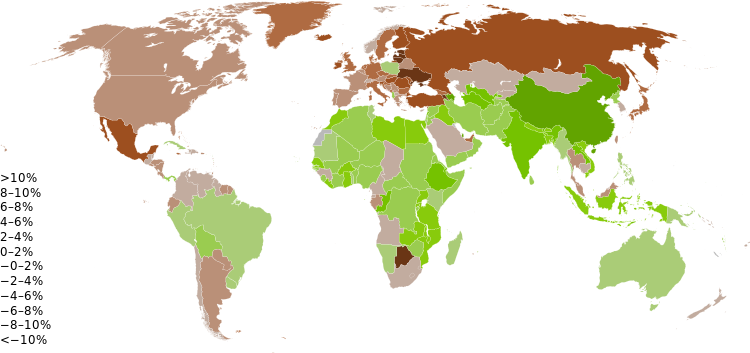

B. Riley Securities has raised its financial estimates for AMC Entertainment Holdings Inc., citing a broader cinema-industry rebound and increased confidence in the company’s ability to surpass prepandemic Adjusted Ebitda levels even if attendance doesn’t fully recover. The firm lifted AMC’s third-quarter revenue estimate to $1.315 billion from $1.260 billion, while also raising its adjusted Ebitda estimate to $172 million from $135 million. Analyst Eric Wold highlighted the domestic and European circuits benefiting from share gains coming out of the pandemic. Imax Corp. is B. Riley’s top sector pick for 2025, thanks to its global film slate and potential benefits in underserved regions.

Factuality Level: 8

Factuality Justification: The article provides accurate information about AMC Entertainment Holdings Inc.’s financial estimates and industry trends, citing a specific analyst’s opinion and comparing the current situation to pre-pandemic levels. It also mentions related news about Imax Corp., but with limited personal perspective or sensationalism.

Noise Level: 3

Noise Justification: The article provides relevant information about AMC Entertainment Holdings’ financial performance and industry trends, with a focus on the company’s revenue and EBITDA estimates. It also mentions Imax Corp as B. Riley’s top sector pick for 2025. However, it lacks in-depth analysis or exploration of long-term possibilities and does not hold powerful people accountable. The article stays on topic but could benefit from more evidence and data to support its claims.

Public Companies: AMC Entertainment Holdings Inc. (AMC), Imax Corp. (IMAX)

Key People: Eric Wold (Analyst at B. Riley Securities)

Financial Relevance: Yes

Financial Markets Impacted: Yes

Financial Rating Justification: The article discusses AMC Entertainment Holdings Inc.’s financial estimates being raised by B. Riley Securities, the company’s performance in the third quarter, and its impact on financial markets as shares climb. It also mentions analyst expectations for sales and the potential impact of a Chinese government stimulus package on Imax Corp. These topics are related to financial topics and have an effect on the companies involved.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no extreme event mentioned in the article.

Move Size: No market move size mentioned.

Sector: Technology

Direction: Up

Magnitude: Medium

Affected Instruments: Stocks

www.marketwatch.com

www.marketwatch.com