From lithium dreams to presidential aspirations, Teague Egan is a man on a mission.

- Teague Egan aims to build the world’s largest lithium company, EnergyX, despite lacking a mining background.

- He has attracted significant investments from major companies like General Motors and Eni.

- Egan’s ambitious plans include producing up to 1 million tons of lithium annually by 2033.

- The lithium market is projected to grow significantly, reaching over $36 billion by 2030.

- Egan is also interested in living to 150 years old and has political aspirations for a future presidential run.

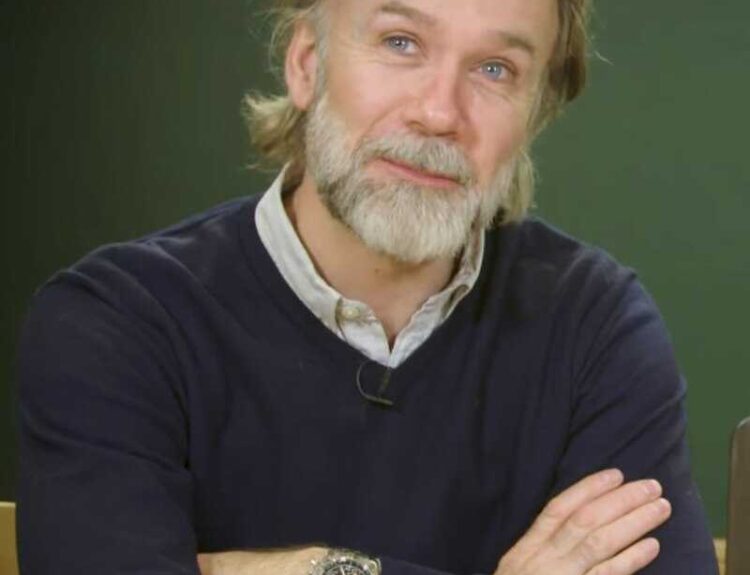

Teague Egan, a 36-year-old entrepreneur, has set his sights on becoming the world’s leading lithium producer through his company, Energy Exploration Technologies, or EnergyX. Despite having no formal background in mining or chemical engineering, Egan’s bold ambitions have attracted high-profile investors, including General Motors and Eni. He envisions producing between 500,000 and 1 million tons of lithium annually by 2033, a target that some industry experts deem unrealistic given that established companies like Albemarle and SQM produced less than 200,000 tons last year.nnThe lithium market is poised for growth, with projections indicating it could exceed $36 billion by 2030, driven by the increasing demand for electric vehicle batteries. However, the current year has been challenging for lithium companies, with prices plummeting due to a slowdown in EV sales and an oversupply in the market.nnEgan, who previously invested in Tesla and has a passion for the energy transition, believes in the long-term potential of lithium. He emphasizes that his interest in the metal is not about short-term profits but about contributing to a sustainable future. His company has developed a technology for direct lithium extraction, which claims to be more efficient than traditional methods, although it has yet to be proven commercially at scale.nnIn addition to his business ambitions, Egan has personal goals that include living to 150 years old and potentially running for president in 2036. He attributes his entrepreneurial spirit to his father, Michael Egan, the former majority owner of Alamo Rent a Car. With a mix of ambition and a tech-bro persona, Egan is determined to make his mark in the lithium industry and beyond.·

Factuality Level: 6

Factuality Justification: The article provides a mix of factual information about Teague Egan and his company, EnergyX, but also includes subjective opinions and speculative claims that may not be universally accepted. While it covers relevant details about the lithium market and Egan’s ambitions, it occasionally veers into sensationalism and lacks rigorous evidence for some of the claims made about the company’s technology and future prospects.·

Noise Level: 6

Noise Justification: The article provides a detailed overview of Teague Egan’s ambitions and the lithium market, but it also includes speculative claims and lacks substantial evidence to support some of Egan’s assertions. While it touches on relevant industry trends and challenges, it does not deeply analyze the implications or hold powerful figures accountable, which detracts from its overall rigor.·

Public Companies: Tesla (TSLA), General Motors (GM), Albemarle (ALB), SQM (SQM), Exxon Mobil (XOM)

Private Companies: Energy Exploration Technologies (EnergyX),Eni,Posco

Key People: Teague Egan (CEO of EnergyX), Michael Egan (Former Chairman and Majority Owner of Alamo Rent a Car), Ari Emanuel (Adviser to EnergyX)

Financial Relevance: Yes

Financial Markets Impacted: Yes

Financial Rating Justification: The article discusses Teague Egan’s ambitions to build a major lithium company, EnergyX, which is directly related to the financial markets due to the lithium industry’s significance in the electric vehicle sector. The article highlights the current challenges faced by lithium companies, including price crashes and market saturation, which impact financial performance. Additionally, the mention of investments from major corporations like General Motors and the projected growth of the lithium market to over $36 billion by 2030 indicates significant financial implications for companies involved in this sector.·

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: The article discusses Teague Egan’s ambitions and the state of the lithium market but does not report on any extreme event that occurred in the last 48 hours.·

Deal Size: 800000000

Move Size: No market move size mentioned.

Sector: All

Direction: Down

Magnitude: Large

Affected Instruments: Stocks

www.wsj.com

www.wsj.com