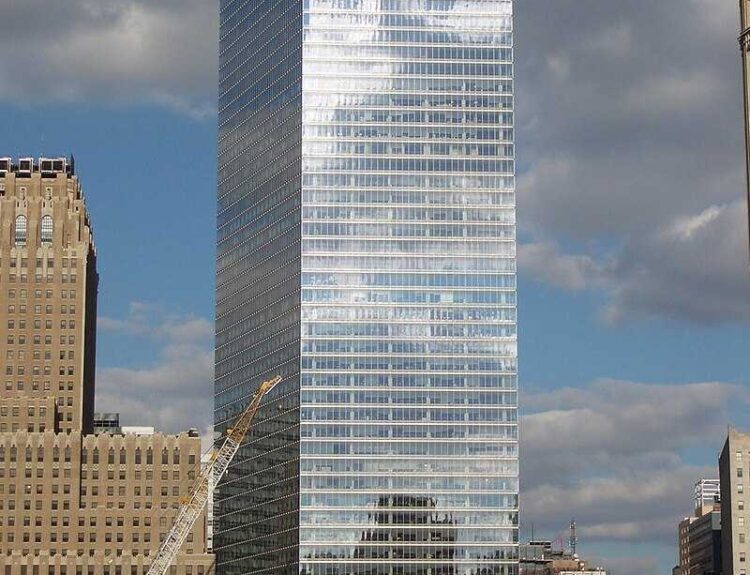

- DXP Enterprises refinanced an existing loan and raised $125 million in borrowings

- The company is a distributor of products and services for industrial customers

- The funds were raised through term loan B borrowings

- DXP now has $550 million in senior secured term loan B borrowings

- The proceeds will be used to repay existing borrowings and for general corporate purposes, potential acquisitions, and transaction fees

- Chief Executive David Little stated that the financing will support the company’s strategy and funding for working capital, acquisition growth, and reinvesting in the business

DXP Enterprises has successfully refinanced its loan and raised $125 million in additional borrowings. The company, which specializes in distributing products and services to industrial customers, closed the refinancing on its existing senior secured term loan B borrowings and secured the new funds through term loan B borrowings. With the new borrowings, DXP now has a total of $550 million in senior secured term loan B borrowings. The proceeds from the refinancing will be used to repay existing borrowings and for general corporate purposes, potential acquisitions, and transaction fees. Chief Executive David Little expressed confidence that this financing will support the company’s strategy, enabling it to fund working capital, pursue acquisition opportunities, and reinvest in the business.