Geopolitical premium not reflected in oil prices

- Crude oil futures rise on extension of Saudi and Russian output cuts

- Geopolitical premium not built into oil prices despite events in the Middle East

- Gasoline futures may be finding some footing

- Diesel futures modestly higher

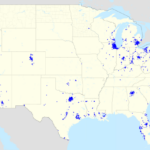

- Refined product prices influenced by refinery maintenance and conversions

Crude oil futures were higher on Monday as Saudi Arabia and Russia announced their commitment to continue limiting output through the end of the year. Despite events in the Middle East, oil prices do not have a geopolitical premium built into them, according to analysts. Gasoline futures, which have weakened in recent weeks, may be stabilizing. Diesel futures also saw a modest increase. Refined product prices will be influenced by refinery maintenance and conversions, with various US refineries expected to return to full operation at different times. Overall, the extension of output cuts by Saudi Arabia and Russia has led to a rise in oil futures.

Factuality Level: 7

Factuality Justification: The article provides information about the current state of crude oil futures and gasoline and diesel prices. It includes specific data and mentions industry sources. However, it does not provide any sources or references to support the claims made by analysts and market sources. Additionally, the article contains some tangential information about refinery maintenance and future plans, which may not be directly relevant to the main topic.

Noise Level: 3

Noise Justification: The article provides information on crude oil futures and prices, but it contains a lot of irrelevant details about specific refineries and their maintenance schedules. The article also includes unnecessary information about the company that created the content. Overall, the article could have been more focused and concise.

Financial Relevance: Yes

Financial Markets Impacted: Crude oil futures markets

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article discusses the current state of crude oil futures and the impact of Saudi Arabia and Russia’s decision to continue limiting output. There is no mention of any extreme events or their impact.

Public Companies: Saudi Arabia (), Russia (), Hamas (), Monroe Energy (), PBF Energy (), Phillips 66 (), Valero ()

Key People: Tom Kloza (Reporter), Jeff Barber (Editor)

www.marketwatch.com

www.marketwatch.com