Auction results fall short of expectations

- Weak demand for $24 billion 30-year Treasury bond auction

- Bid-to-cover ratio and yield concession lower than expected

- Auction seen as important test of demand

- Treasury yields rise after auction results

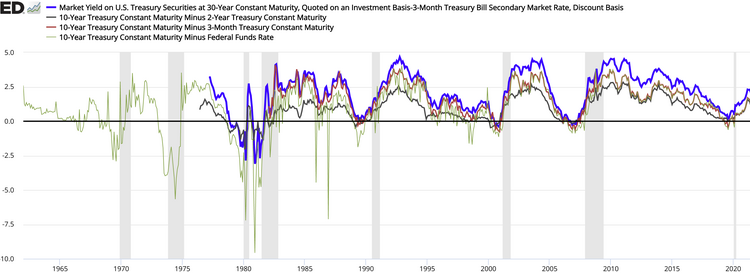

Thursday afternoon’s $24 billion sale of 30-year Treasury bonds drew weaker-than-expected demand, with the bid-to-cover ratio and yield concession coming in lower than anticipated. The auction, which capped a series of sales totaling $112 billion, was seen as an important test of demand. Following the release of the auction results, Treasury yields rose slightly, reflecting a further selloff in underlying government debt.

Public Companies:

Private Companies: undefined

Key People: Greg Faranello (head of U.S. rates trading and strategy at AmeriVet Securities)

Factuality Level: 7

Justification: The article provides information about the weaker-than-expected demand for the sale of 30-year Treasury bonds, citing a source from AmeriVet Securities. It also mentions the bid-to-cover ratio and yield concession. The article includes details about the recent trio of sales and the impact on Treasury yields. However, it lacks additional context and analysis, and there is no mention of any opposing viewpoints or potential reasons for the weaker demand.

Noise Level: 7

Justification: The article provides some relevant information about the weaker-than-expected demand for 30-year Treasury bonds and the impact on Treasury yields. However, it lacks in-depth analysis, evidence, and actionable insights. It also does not explore the consequences of the auction results on those who bear the risks or provide information on antifragility or long-term trends.

Financial Relevance: Yes

Financial Markets Impacted: Treasury bond market

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article discusses the weaker-than-expected demand for 30-year Treasury bonds, which can impact the Treasury bond market.

www.marketwatch.com

www.marketwatch.com  www.barrons.com

www.barrons.com