Enacted law requires firms to disclose startup diversity data

- California has enacted a new diversity disclosure law for venture-capital firms

- The law requires firms to provide data on the gender and racial makeup of the startups they back

- Legal analysts believe the law could have a wider impact beyond venture-capital firms

- Other types of money managers, even those outside of California, may need to comply with the law

California has recently enacted a new diversity disclosure law that targets venture-capital firms. The law mandates that these firms provide data on the gender and racial makeup of the startups they back. However, legal analysts believe that the impact of this law could extend beyond venture-capital firms. Other types of money managers, even those outside of California, may need to comply with the law. This new legislation highlights the growing importance of diversity and inclusion in the finance industry.

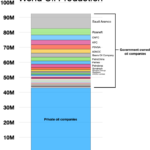

Public Companies:

Private Companies:

Key People:

Factuality Level: 7

Justification: The article provides information about a new diversity disclosure law in California that requires venture-capital firms to provide data on the gender and racial makeup of the startups they back. It also mentions that legal analysts believe the law could have a wider impact beyond venture investors and California-based firms. The article does not contain any irrelevant or misleading information, sensationalism, redundancy, or opinion masquerading as fact. It does not include digressions, unnecessary background information, or tangential details. The reporting appears to be accurate and objective, without any misleading information, disinformation, or propaganda. There is no exaggerated or overly dramatic reporting. The article does not include repetitive information. While the article does not explicitly state any bias or personal perspective, it is important to note that the information provided is based on legal analysts’ opinions. There are no invalid arguments, logical errors, inconsistencies, fallacies, faulty reasoning, false assumptions, or incorrect conclusions. Overall, the article provides factual information about the new diversity disclosure law and its potential impact.

Noise Level: 7

Justification: The article provides some information about a new diversity disclosure law in California aimed at venture-capital firms. However, it lacks in-depth analysis, evidence, and actionable insights. It also briefly mentions that other types of money managers need to take notice, but does not provide any further information or explanation. Overall, the article is relatively short and lacks substance, making it closer to noise level 7.

Financial Relevance: Yes

Financial Markets Impacted: Venture-capital firms and other types of money managers

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article discusses a new diversity disclosure law in California that could have a wider impact on venture-capital firms and other types of money managers. However, there is no mention of any extreme event or its impact.

www.wsj.com

www.wsj.com