Investors anticipate easing inflation and potential rate cut

- Treasury yields hold just above seven-week lows

- Investors betting on Fed cutting interest rates next year

- Yields on 2-year, 10-year, and 30-year Treasuries rise slightly

- Market assumes Fed is done raising rates

- 95% probability of no rate change at next Fed meeting

- Increased chances of rate cut in May

- Producer prices report and other economic updates expected

- U.K. inflation data shows success in tackling inflation

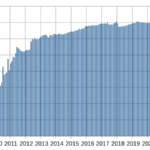

Ten-year Treasury yields remain near seven-week lows as investors continue to bet on the Federal Reserve cutting interest rates next year. Yields on the 2-year, 10-year, and 30-year Treasuries have seen slight increases, but the market assumes that the Fed is done raising rates. There is a 95% probability of no rate change at the next Fed meeting, and the chances of a rate cut in May have increased. Bond investors are awaiting the producer prices report and other economic updates. In the U.K., inflation data shows success in tackling inflation.

Factuality Level: 8

Factuality Justification: The article provides information about the current yields on Treasury bonds and the factors driving the market. It includes quotes from experts and mentions market probabilities. The article also mentions upcoming economic updates and provides data on U.K. gilt yields. Overall, the information provided is factual and supported by sources.

Noise Level: 3

Noise Justification: The article primarily focuses on the movement of Treasury yields and the market’s expectations of interest rate cuts by the Federal Reserve. It provides some context and quotes from experts, but there is limited analysis or exploration of long-term trends or antifragility. The article also includes unrelated information about inflation in the UK and quotes from an economist. Overall, the article lacks depth and actionable insights.

Financial Relevance: Yes

Financial Markets Impacted: The article discusses the yield on Treasury bonds, which is relevant to financial markets and investors.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article primarily focuses on the movement of Treasury bond yields and the market’s expectations of interest rate cuts by the Federal Reserve. There is no mention of any extreme events or their impact.

Public Companies: SPI Asset Management (N/A)

Private Companies: Comerica Bank

Key People: Stephen Innes (Managing Partner at SPI Asset Management), Bill Adams (Chief Economist at Comerica Bank)

www.marketwatch.com

www.marketwatch.com