October sees a decrease in import price index

- Cost of imported goods fell 0.8% in October

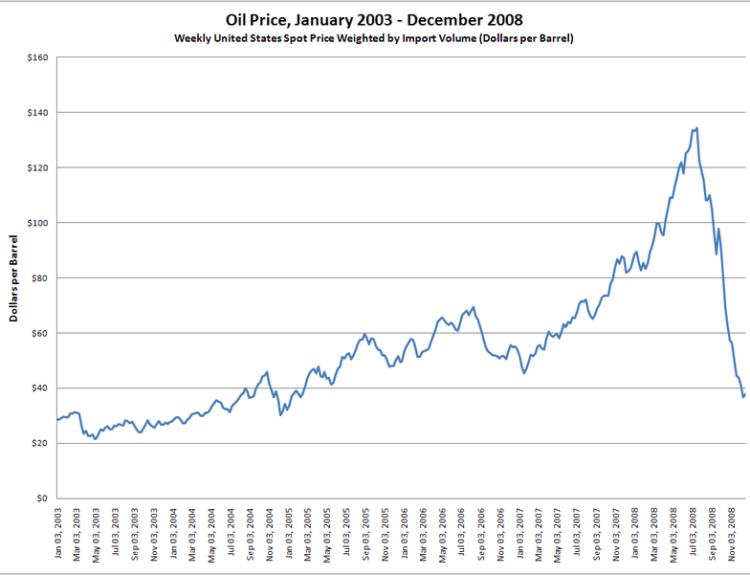

- Oil prices decline contributed to the decrease

- Economists had estimated a 0.3% drop

- Import prices declined by 0.2% excluding fuel

- Stock markets expected to open lower

The cost of imported goods in the U.S. fell by 0.8% in October, mainly due to a decline in oil prices. This decrease was larger than what economists had predicted, with estimates pointing to a 0.3% drop. Excluding fuel, import prices declined by a smaller 0.2% last month. As a result, inflationary pressures were tamped down. In the stock markets, the Dow Jones Industrial Average and S&P 500 were expected to open lower in Friday trading.

Factuality Level: 7

Factuality Justification: The article provides information about the cost of imported goods falling in October, with economists’ estimates and government data mentioned. However, the article is very short and lacks in-depth analysis or additional context.

Noise Level: 2

Noise Justification: The article is very short and mostly consists of filler content, such as a request for feedback and email address. The actual information provided is limited and lacks depth. There is no evidence, data, or analysis to support the claims made. Overall, the article is not informative or insightful.

Financial Relevance: Yes

Financial Markets Impacted: The article mentions the Dow Jones Industrial Average and S&P 500, indicating that financial markets may be impacted.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article discusses the cost of imported goods and its impact on the stock market, suggesting financial relevance.

Public Companies: Dow Jones Industrial Average (DJIA), S&P 500 (SPX)

Key People:

Reported publicly:

www.marketwatch.com

www.marketwatch.com