Consumers Holding Back as Hormel Stock Plummets

- Hormel Foods is the leading decliner in the S&P 500

- Disappointing earnings reported as consumers hold back

- Fiscal fourth-quarter earnings of 42 cents a share on revenue of $3.2 billion

- Lower-than-expected earnings for fiscal 2024

- Hormel stock has dropped 33% this year

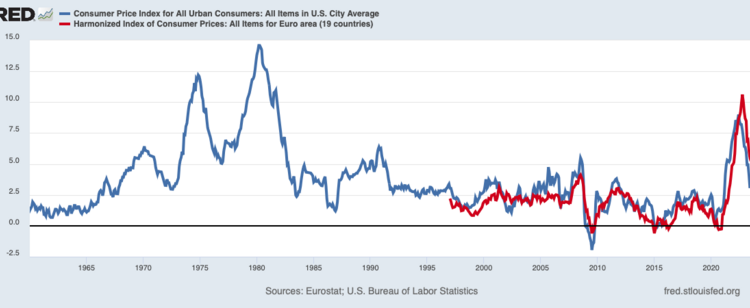

Hormel Foods, the maker of processed foods, has become the leading decliner in the S&P 500. The company reported disappointing earnings for the fiscal fourth quarter, with earnings of 42 cents a share on revenue of $3.2 billion. This fell short of analysts’ expectations of 44 cents a share on revenue of $3.26 billion. Hormel’s CEO, Jim Snee, attributed the challenges to slowing consumer demand, inflationary pressures, and headwinds in the turkey business. Looking ahead, Hormel expects lower-than-expected earnings per share of $1.51 to $1.65 for fiscal 2024. As a result, Hormel stock has dropped 33% this year, making it the worst performer in the S&P 500. This decline reflects a challenging consumer environment, as other retailers like Dollar Tree and Petco Health & Wellness also reported difficulties due to lower-income consumers responding to inflation and reduced government benefits.

Public Companies: Hormel Foods (HRL), Dollar Tree (DLTR), Petco Health & Wellness (WOOF)

Private Companies:

Key People: Jim Snee (CEO of Hormel Foods), Rick Dreiling (CEO of Dollar Tree), Ron Coughlin (CEO of Petco Health & Wellness)

Factuality Level: 7

Justification: The article provides specific information about Hormel Foods’ disappointing earnings and compares them to analyst expectations. It includes quotes from the CEO and mentions the stock performance. However, the article lacks in-depth analysis and context about the factors contributing to the decline in earnings and the overall market conditions.

Noise Level: 3

Justification: The article provides relevant information about Hormel Foods’ disappointing earnings and the reasons behind it. However, it contains some filler content, such as the mention of Dollar Tree and Petco Health & Wellness, which are not directly related to Hormel’s performance.

Financial Relevance: Yes

Financial Markets Impacted: Hormel Foods stock

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article pertains to financial topics as it discusses the disappointing earnings of Hormel Foods and its impact on the company’s stock. However, there is no mention of an extreme event.

www.marketwatch.com

www.marketwatch.com