Assessing the Impact of OPEC+ Production Cuts

- Crude futures lower, while refined products see modest gains

- Traders assessing potential impact of additional OPEC+ production cuts

- Disappointment over lack of strong actions to enforce compliance with output reductions

- NYMEX January West Texas Intermediate down 52 cents at $73.55 a barrel

- NYMEX January RBOB contract up 1.18 cents to $2.1329/gal

- Retail gasoline prices expected to drop by about 1 cent

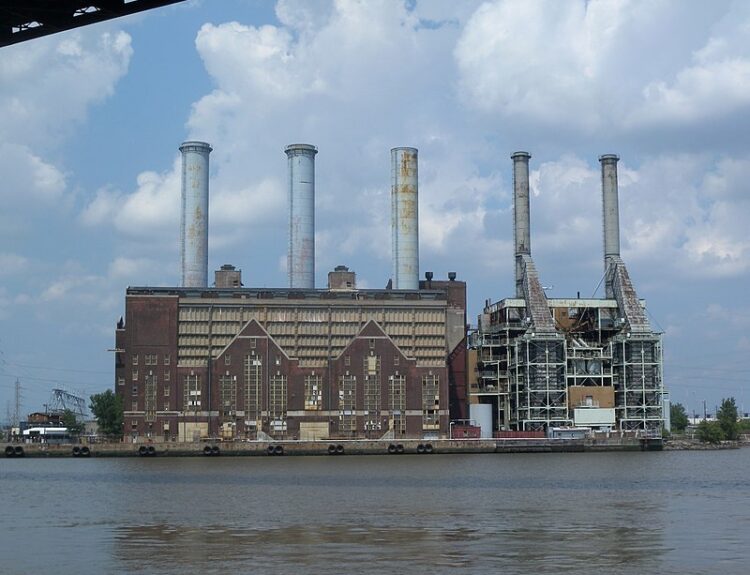

Petroleum futures were posting modest moves at midday Monday as traders continue to assess the potential impact of additional OPEC+ production cuts. The NYMEX January West Texas Intermediate contract was down 52 cents at $73.55 a barrel, while the NYMEX January RBOB contract was up 1.18 cents to $2.1329/gal. Retail gasoline prices are expected to drop by about 1 cent.

Factuality Level: 7

Factuality Justification: The article provides information about the current state of petroleum futures and the potential impact of additional OPEC+ production cuts. It includes specific price movements and market trends. However, it does not provide any sources or data to support the claims made, and it includes some unnecessary details about gasoline prices and temperature forecasts that are tangential to the main topic.

Noise Level: 6

Noise Justification: The article provides information on petroleum futures and the potential impact of additional OPEC+ production cuts. It also mentions the disappointment of market bulls and the lack of strong actions to enforce compliance. The article includes details on crude futures, refined products, gasoline prices, and diesel prices. However, it lacks in-depth analysis, scientific rigor, and actionable insights. It stays on topic but does not provide evidence or data to support its claims.

Financial Relevance: Yes

Financial Markets Impacted: The article provides information on petroleum futures and the potential impact of additional OPEC+ production cuts. This can impact the energy sector and companies involved in the oil industry.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article discusses the potential impact of OPEC+ production cuts on petroleum futures, which is relevant to financial markets. However, there is no mention of an extreme event or its impact.

Public Companies: OPEC (N/A)

Private Companies: Oil Price Information Service,Dow Jones & Co

Key People: Tom Kloza (Reporter), Jeff Barber (Editor)

www.marketwatch.com

www.marketwatch.com