Tech giants adopt AMD’s MI300X accelerators, but Nvidia remains dominant

- AMD shares have risen 80% this year

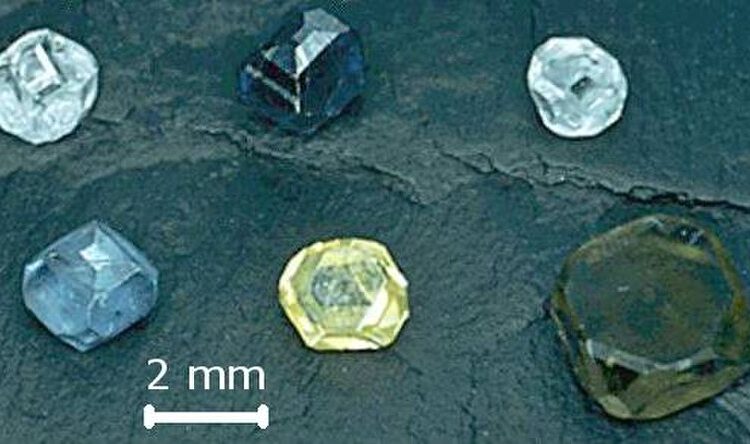

- AMD’s Instinct MI300X accelerators are available for sale

- MI300X products can outperform Nvidia’s H100 HGX server platform by up to 60%

- Microsoft, Meta, and Oracle have adopted or are in the process of adopting the MI300X accelerators

- Melius Research rates AMD at Hold with a price target of $125

- Raymond James rates AMD at Strong Buy with a price target of $140

- Oppenheimer analysts remain cautious about AMD’s AI vision

AMD’s artificial intelligence event has garnered positive attention from Wall Street. The company’s shares have surged 80% this year, and its Instinct MI300X accelerators are now available for sale. These accelerators can outperform Nvidia’s H100 HGX server platform by up to 60% for certain AI model inference workloads. Tech giants like Microsoft, Meta, and Oracle have either adopted or are in the process of adopting the MI300X accelerators, leading to optimism among analysts. Melius Research rates AMD at Hold, while Raymond James rates it at Strong Buy and Oppenheimer remains cautious about AMD’s AI vision.

Factuality Level: 7

Factuality Justification: The article provides information about AMD’s recent developments and the interest it has received from tech giants like Microsoft and Meta Platforms. It includes quotes from analysts who have different opinions on AMD’s prospects. However, the article lacks in-depth analysis and does not provide a balanced view of the topic.

Noise Level: 3

Noise Justification: The article provides relevant information about Advanced Micro Devices (AMD) and its recent developments in the artificial intelligence market. It mentions the interest from tech giants like Microsoft and Meta Platforms, the availability of its accelerators for data-center customers, and the launch of a new lineup of laptop processors. The article also includes commentary from analysts at Melius Research, Raymond James, and Oppenheimer. However, the article lacks in-depth analysis, scientific rigor, and actionable insights. It mainly focuses on the stock performance of AMD and the opinions of analysts, without providing much context or evidence to support their claims. Overall, the article contains some noise and filler content, but it does provide some relevant information.

Financial Relevance: Yes

Financial Markets Impacted: AMD shares

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article pertains to the financial topic of Advanced Micro Devices (AMD) and its performance in the market. It discusses the rise in AMD shares and the company’s artificial intelligence event. While the article mentions interest from tech giants like Microsoft and Meta Platforms, there is no mention of any extreme event or its impact.

Public Companies: Advanced Micro Devices (AMD), Microsoft (MSFT), Meta Platforms (META), Oracle (ORCL), Nvidia (NVDA)

Key People: Emily Dattilo (Author)

Reported publicly:

www.marketwatch.com

www.marketwatch.com