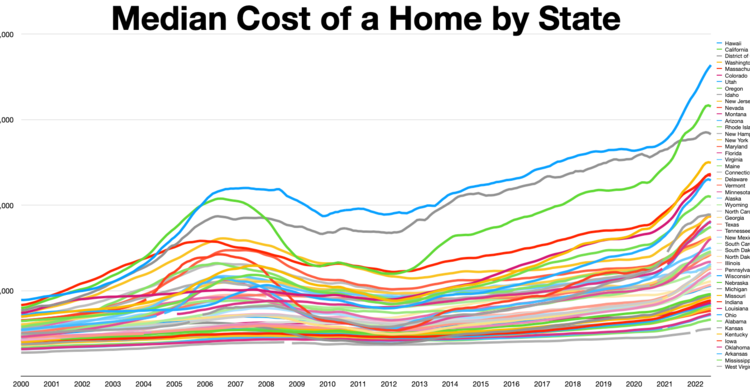

Record-high housing costs and low affordability in 2023, but improvement expected in 2024

- U.S. homes were the least affordable on record in 2023

- Someone making the median U.S. income would’ve had to spend 41.4% of their earnings on monthly housing costs

- 2023 was the least affordable year for housing in recent history

- Monthly housing costs have outpaced income growth

- Housing affordability is already improving in 2024

- Austin, Texas, was the only metro area that became more affordable in the past year

- Anaheim, California, had the biggest decrease in affordability

- Miami had the second-largest decrease in affordability

- Affordability is expected to improve in 2024 with increased listing inventory, lower mortgage rates, and falling home prices

The year 2023 marked the worst year for home-buying in terms of affordability, with U.S. homes being the least affordable on record. Someone with the median U.S. income would have had to spend 41.4% of their earnings on monthly housing costs. This percentage is the highest since 2012 and represents an increase from the previous year. The increase in monthly housing costs has outpaced income growth, with the median monthly payment rising by 12.6% while median household income increased by just 5.2%. However, there is hope for home buyers in 2024 as housing affordability is already improving. Mortgage rates are expected to come down, more homes are being listed for sale, and there are still many potential buyers waiting for fresh inventory. Among the 50 U.S. metro areas tracked, only Austin, Texas, became more affordable in the past year, while Anaheim, California, and Miami experienced the biggest decreases in affordability. Looking ahead, it is expected that listing inventory will increase, mortgage rates will drop, and home prices will fall in 2024, leading to improved affordability.

Factuality Level: 7

Factuality Justification: The article provides data from a report by Redfin, a reputable real estate company, which supports the claims made about housing affordability. However, the article does not provide any counterarguments or alternative perspectives, which could affect the overall factuality level.

Noise Level: 4

Noise Justification: The article provides information on the affordability of home-buying in the US, specifically in 2023 and projections for 2024. It includes data on housing costs, income levels, and mortgage rates. However, the article lacks in-depth analysis and does not provide evidence or examples to support its claims. It also does not explore the consequences of the housing affordability issue on individuals or society. Overall, the article contains some relevant information but lacks depth and supporting evidence.

Financial Relevance: Yes

Financial Markets Impacted: Housing market, mortgage rates

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article discusses the affordability of housing and its impact on home-buying. It provides information on the housing market, mortgage rates, and changes in affordability. However, there is no mention of any extreme events or their impact.

Public Companies: Redfin (REDF)

Key People: Elijah de la Campa (Redfin senior economist)

Reported publicly:

www.marketwatch.com

www.marketwatch.com