How AbbVie could outperform the struggling pharmaceutical sector

- Goldman Sachs analyst upgrades AbbVie to Buy from Neutral

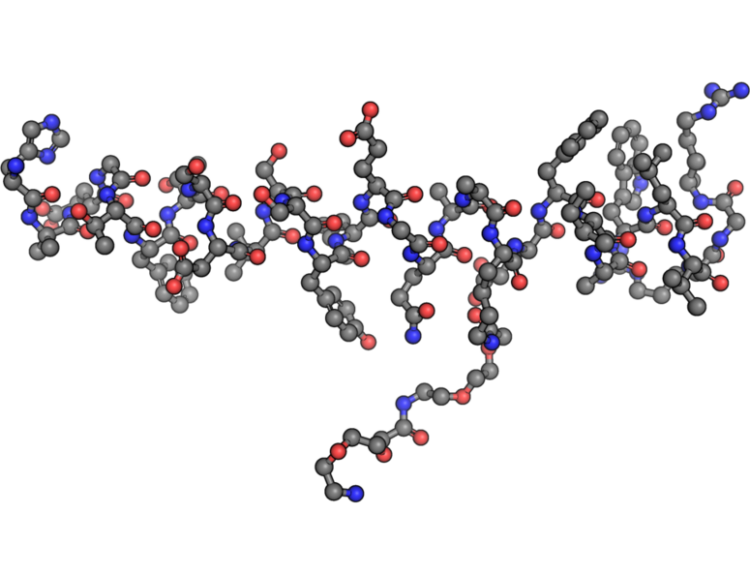

- Sales of AbbVie’s blockbuster drug Humira have held up better than expected

- AbbVie’s core immunology franchise shows robust revenue

- AbbVie’s aesthetics franchise could reaccelerate in 2024

- AbbVie’s improvement might not be shared by the wider industry

- Profit trajectories could be the biggest factor in the group’s stock performance in 2024

AbbVie, a large pharmaceutical company, has been upgraded to Buy by a Goldman Sachs analyst. The sales of AbbVie’s popular drug Humira have exceeded expectations, and the company’s core immunology franchise has shown strong revenue. Additionally, AbbVie’s aesthetics franchise is expected to gain momentum in 2024. While the wider pharmaceutical industry continues to face challenges, AbbVie’s positive outlook sets it apart. However, investors should consider profit trajectories as a key factor in the industry’s stock performance in the coming year. Overall, AbbVie’s potential for growth in 2024 presents an opportunity for investors in the pharmaceutical sector.

Public Companies: AbbVie (ABBV), Goldman Sachs (GS), Bristol Myers Squibb (BMY), Pfizer (PFE), Merck (MRK)

Private Companies:

Key People: Chris Shibutani (Analyst)

Factuality Level: 7

Justification: The article provides information about an analyst upgrading AbbVie to Buy from Neutral, with a $173 price target. It also discusses the performance of AbbVie’s drugs and the potential for the company’s earnings. The article includes some background information and mentions the performance of the pharmaceutical sector. Overall, the article provides factual information about the analyst’s upgrade and the reasons behind it.

Noise Level: 6

Justification: The article provides some relevant information about AbbVie and its potential in the pharmaceutical sector. However, it contains some repetitive information and lacks in-depth analysis or evidence to support its claims. The article also includes some irrelevant information about the analyst’s other stock ratings, which is unrelated to the main topic.

Financial Relevance: Yes

Financial Markets Impacted: The article provides information about the pharmaceutical sector, specifically mentioning AbbVie. It discusses the potential for AbbVie’s stock to perform well in the future due to the sales of its blockbuster drug Humira and the performance of its other products. This information could impact the stock market and investors in the pharmaceutical industry.

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article focuses on the financial performance and potential of AbbVie in the pharmaceutical sector. It does not mention any extreme events or their impact.

www.marketwatch.com

www.marketwatch.com