Tensions and fears of supply disruptions drive up prices

- Oil prices rise after Iranian warship enters Red Sea

- Tensions and fears of crude supply disruptions increase

- West Texas Intermediate crude up 2.4% to $73.36 a barrel

- Brent crude up 2.4% to $78.90 a barrel

- Uncertainty over demand outlook and high U.S. production weigh on crude prices

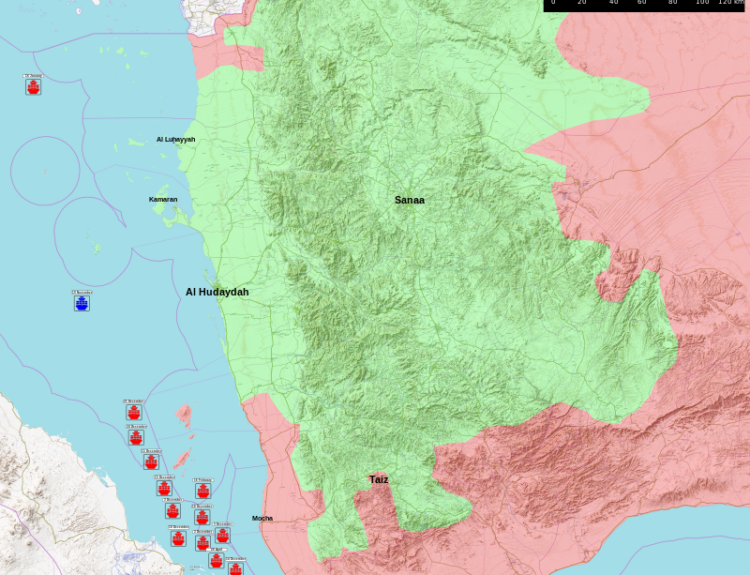

Oil prices surged as an Iranian warship entered the Red Sea, raising concerns about potential disruptions to crude supply. West Texas Intermediate crude rose 2.4% to $73.36 a barrel, while Brent crude increased by the same percentage to $78.90 a barrel. These price gains reflect the heightened tensions in the region and the ongoing conflict between Iran-backed Houthi rebels in Yemen and the United States. However, uncertainty over the demand outlook and record-high U.S. crude production continue to weigh on the market, limiting the potential for a sustained recovery in oil prices.

Public Companies:

Private Companies: undefined

Key People: Charalampos Pissouros (Senior Investment Analyst at XM)

Factuality Level: 7

Justification: The article provides information about the rise in oil futures due to tensions in the Red Sea caused by an Iranian warship and attacks on shipping by Iran-backed rebels. It also mentions the rise in oil prices during the Israel-Hamas war and the factors that have affected crude prices. The information seems to be based on news reports and quotes from analysts, but there is no indication of any bias or personal perspective. However, the article could provide more context and analysis to support its claims.

Noise Level: 3

Justification: The article provides relevant information about the rise in oil futures due to tensions in the Red Sea and attacks on shipping by Iran-backed rebels. However, it lacks in-depth analysis, scientific rigor, and actionable insights. It also includes some repetitive information and does not explore the consequences of these events on those who bear the risks.

Financial Relevance: Yes

Financial Markets Impacted: Oil futures market

Presence of Extreme Event: Yes

Nature of Extreme Event: Political Upheaval or Revolution

Impact Rating of the Extreme Event: Minor

Justification: The article mentions the entry of an Iranian warship into the Red Sea, which has heightened tensions and fears of crude supply disruptions. This political upheaval has the potential to impact the oil futures market.

www.marketwatch.com

www.marketwatch.com