What can investors expect and how should they prepare?

- Stocks tend to rally in the year before Election Day

- Pre-election gains may have already occurred

- Markets tend to be more volatile in election years

- Investors are pricing in more interest rate cuts than the Federal Reserve is likely to deliver

- Stocks are trading at a 20% premium to their average valuation since 2010

- 2024 election is likely to be highly contentious

- Increasing worries over U.S. political dysfunction

- Contested election result could drive higher market volatility

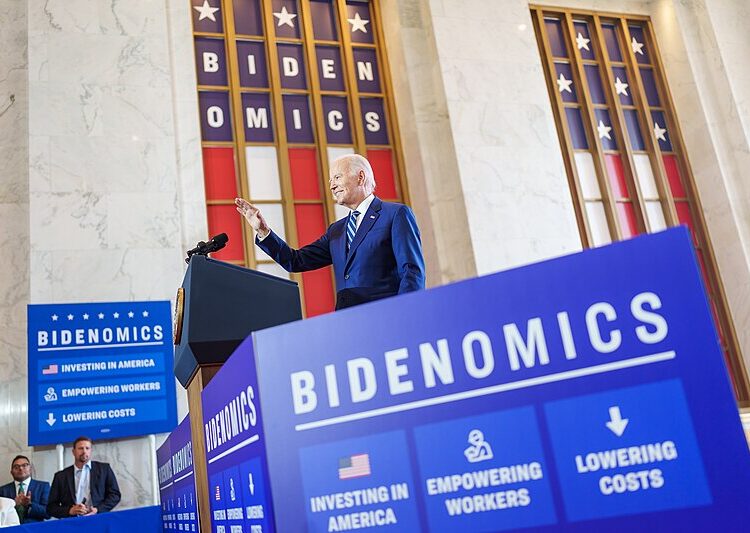

- Stocks have never posted a yearly decline when an incumbent president ran for re-election

- Presidents who avoid recession in the two years before re-election tend to win a second term

- Stock market performance can reflect a candidate’s prospects

- Stock market direction has telegraphed the election outcome in the past

- Strong rally in U.S. stocks in 2023

- Playing defense and focusing on dividend growers and global infrastructure stocks

Investors are facing an uncertain and potentially volatile stock market as the 2024 U.S. presidential election approaches. While history shows that stocks tend to rally in the year before Election Day, there are concerns that pre-election gains may have already occurred. Additionally, election years are typically more volatile, and investors may be overestimating the number of interest rate cuts the Federal Reserve will make. Stocks are also trading at a premium, and the election is expected to be highly contentious. Worries over U.S. political dysfunction are increasing, and a contested election result could drive even higher market volatility. However, there are some patterns to consider. Stocks have historically performed well when an incumbent president runs for re-election and when the economy is strong. The stock market has also shown some predictive power in determining the election outcome. In 2023, U.S. stocks saw a strong rally, but there are concerns about the staying power of the consumer. In this uncertain environment, investors may want to consider playing defense by focusing on dividend growers and global infrastructure stocks. These sectors have historically weathered down markets relatively well. Overall, investors should be prepared for potential market volatility and consider their investment strategies accordingly.

Public Companies: Nuveen (NUVEEN), Comerica Wealth Management (null), Strategas Research Partners (null)

Private Companies:

Key People: Saira Malik (Chief Investment Officer at Nuveen), John Lynch (Chief Investment Officer at Comerica Wealth Management)

Factuality Level: 7

Justification: The article provides historical data and expert opinions on the relationship between presidential elections and stock market performance. However, it also includes some speculative statements and opinions that are presented as facts.

Noise Level: 6

Justification: The article provides some analysis of historical market performance in presidential election years and discusses potential concerns for investors in 2024. However, it also includes irrelevant information about legal cases against Donald Trump and approval ratings for Joe Biden, which are not directly related to the topic of the article.

Financial Relevance: Yes

Financial Markets Impacted: The article discusses the potential impact of the 2024 U.S. presidential election on the stock market and investor sentiment.

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article focuses on the historical performance of the stock market in presidential election years and the potential implications for investors. It does not mention any extreme events.

www.marketwatch.com

www.marketwatch.com