Awaiting Update on U.S. Consumer Price Data

- Bond yields steady ahead of CPI revisions

- Yields on 2-year, 10-year, and 30-year Treasuries

- Focus on recent data to verify disinflation

- Speech from Dallas Fed president on balance sheet tightening

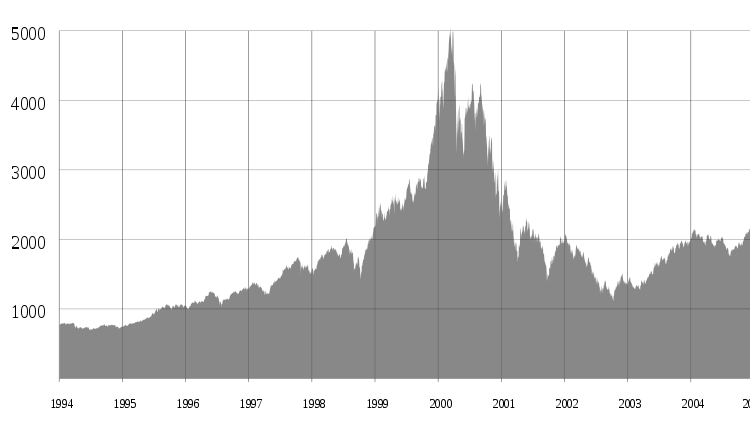

Bond yields remained steady on Friday as traders awaited an important update on U.S. consumer price data. The yield on the 2-year Treasury increased by 0.9 basis points to 4.46%, while the yield on the 10-year Treasury rose by 1.1 basis points to 4.17%. The yield on the 30-year Treasury decreased by 1.1 basis points to 4.37%. The focus of the market is on the Labor Department’s update to the seasonal adjustments of the consumer price index, which will verify the significance of the disinflation as we exited 2023. Last year, this annual revision had a notable impact on the market. Additionally, there will be a speech from Lorie Logan, the Dallas Federal Reserve president, who will discuss the plan to reduce the Fed’s balance sheet tightening program.

Public Companies: Piper Sandler (BX:TMUBMUSD02Y)

Private Companies: Dallas Federal Reserve

Key People: Jake Oubina (Economist at Piper Sandler), Lorie Logan (Dallas Federal Reserve President)

Factuality Level: 8

Justification: The article provides factual information about bond yields and the upcoming update on U.S. consumer price data. It includes quotes from economists and mentions a speech from the Dallas Federal Reserve president. There are no digressions, misleading information, sensationalism, or opinion masquerading as fact. The article is concise and focused on the main topic.

Noise Level: 3

Justification: The article is very short and provides minimal information. It mainly focuses on bond yields and upcoming updates on U.S. consumer price data. There is no analysis, evidence, or actionable insights provided. The article lacks depth and does not explore any long-term trends or consequences of decisions. It also does not hold powerful people accountable or provide any antifragility information. Overall, the article contains mostly noise and filler content.

Financial Relevance: Yes

Financial Markets Impacted: Bond market

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article pertains to financial topics as it discusses bond yields and the upcoming update on U.S. consumer price data. However, there is no mention of any extreme event.

www.marketwatch.com

www.marketwatch.com