Stock falls 10% as earnings and sales miss expectations

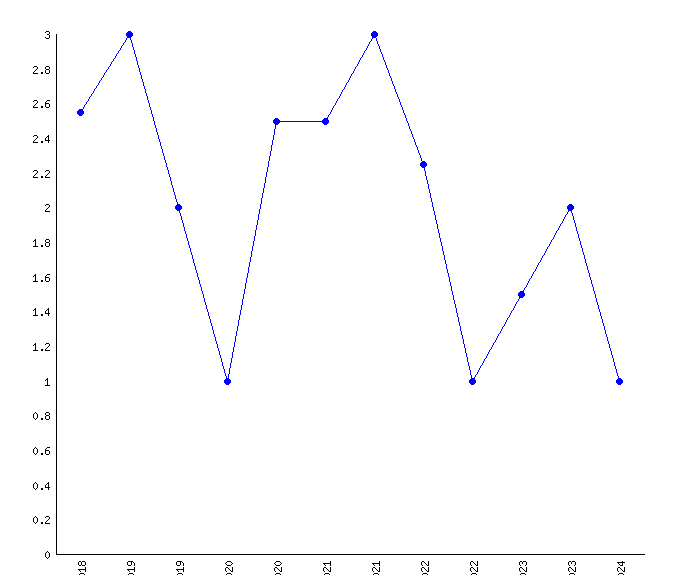

- Wesco International shares fell about 10% after weaker-than-expected 4Q earnings

- Earnings per share dropped from $3.90 to $2.45

- Adjusted earnings were $2.65 per share, below analysts’ forecast of $3.86

- Sales totaled $5.47 billion, below expectations of $5.59 billion

- Chairman John Engel cited disappointing stock and flow sales and project delays

Wesco International shares tumbled approximately 10% in premarket trade following the release of weaker-than-expected fourth-quarter earnings. Earnings per share for the quarter were $2.45, a significant decline from the previous year’s $3.90. Adjusted earnings were also below analysts’ forecast at $2.65 per share. Sales for the quarter totaled $5.47 billion, falling short of the expected $5.59 billion. Chairman John Engel attributed the disappointing results to below-expectation stock and flow sales, as well as delays in certain projects. Despite the decline in sales, Engel noted that quoting and bid levels remained healthy during the quarter.

Public Companies: Wesco International (WCC)

Private Companies:

Key People: John Engel (Chairman, President and Chief Executive)

Factuality Level: 8

Justification: The article provides specific information about Wesco International’s fourth-quarter earnings, including the decline in earnings per share and sales. It also includes a quote from the Chairman, President, and CEO of the company. The information is based on actual financial data and analyst forecasts, which adds to the credibility of the article.

Noise Level: 3

Justification: The article provides factual information about Wesco International’s weaker-than-expected fourth-quarter earnings, including the decline in stock price, earnings per share, and sales. It also includes a quote from the company’s Chairman, President, and CEO. However, there is no analysis or exploration of long-term trends, antifragility, or accountability. The article stays on topic and supports its claims with data and quotes.

Financial Relevance: Yes

Financial Markets Impacted: Wesco International

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article pertains to financial topics as it discusses Wesco International’s weaker-than-expected fourth-quarter earnings and the impact on its stock price.

www.marketwatch.com

www.marketwatch.com