Cost of Rare-Earths Refinery Expected to Exceed Guidance

- Iluka Resources reports a 41% decrease in annual profit

- Revenue falls by 20% to A$1.29 billion

- Final dividend declared at 4 Australian cents per share

- Cost of building rare-earths refinery expected to be at upper end of guidance

- Preliminary design work points to a capital cost of between A$1.7 billion and A$1.8 billion

- China’s lackluster economic recovery impacts demand for zircon

- Iluka’s SR1 asset likely to remain offline unless demand improves

Iluka Resources, a mineral-sands miner, has reported a 41% decrease in its annual net profit, which amounted to 342.6 million Australian dollars. The company’s revenue also fell by 20% to A$1.29 billion. Iluka’s directors declared a final dividend of 4 Australian cents per share, bringing the full-year payout to 7 cents. Additionally, the cost of building the Eneabba rare-earths refinery in Western Australia is expected to be at the upper end of the previously provided guidance of A$1.5 billion-A$1.8 billion. Preliminary design work suggests a capital cost between A$1.7 billion and A$1.8 billion. Iluka has been impacted by China’s slow economic recovery from the Covid-19 pandemic, resulting in decreased demand for zircon. The company’s SR1 asset in the titanium feedstock business is likely to remain offline unless demand improves.

Factuality Level: 9

Factuality Justification: The article provides specific and factual information about Iluka Resources’ annual profit, revenue, dividend declaration, and the cost of building a rare-earths refinery. It includes direct quotes from the company and mentions external factors impacting its operations, such as inflation and China’s economic recovery. The information presented is clear, relevant, and based on financial data.

Noise Level: 3

Noise Justification: The article provides relevant information about Iluka Resources’ annual profit decline, the cost of building a rare-earths refinery, and the impact of various factors on the company’s operations. It stays on topic and supports its claims with data and examples. However, it lacks in-depth analysis, accountability of powerful people, and actionable insights, which prevents it from scoring higher.

Financial Relevance: Yes

Financial Markets Impacted: Iluka Resources

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article discusses Iluka Resources’ annual profit decline and the cost of building a rare-earths refinery. There is no mention of an extreme event.

Public Companies: Iluka Resources (ILU.AX)

Key People: David Winning (Author)

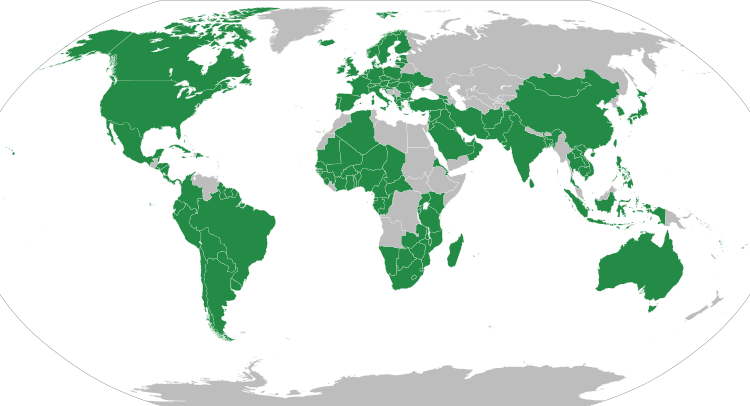

Reported publicly:

www.marketwatch.com

www.marketwatch.com