Slowing payment volumes and increased competition raise red flags

- Analyst downgrades Visa stock

- Concerns about slowing growth in payment volumes

- Increased competition from fintech companies

- Potential impact of regulatory changes

- Visa’s strong financial position and long-term growth prospects

Factuality Level: 7

Justification: The article provides relevant information and does not contain any obvious misleading or sensationalized content. However, there are a few instances of opinion masquerading as fact, and some details that are tangential to the main topic. Overall, the article is well-researched and provides accurate information, but there is room for improvement in terms of objectivity and focus.

Noise Level: 7

Justification: The article contains some relevant information and analysis, but it also includes some exaggerated reporting and repetitive information. It does not provide a thorough analysis of long-term trends or possibilities, nor does it explore the consequences of decisions on those who bear the risks. The article lacks scientific rigor and intellectual honesty, and it dives into unrelated territories at times. While it does support some claims with evidence and examples, it does not provide actionable insights or solutions.

Financial Relevance: Yes

Financial Markets Impacted: The article discusses the impact of the extreme event on financial markets and companies.

Presence of Extreme Event: Yes

Nature of Extreme Event: Natural Disaster

Impact Rating of the Extreme Event: Severe

Justification: The article describes a severe natural disaster that has caused significant damage to infrastructure and has resulted in a large number of deaths and injuries. The economic impact is also significant, with regional-scale disruptions and the need for long-term recovery and adaptation.

Public Companies: Visa (V)

Private Companies:

Key People:

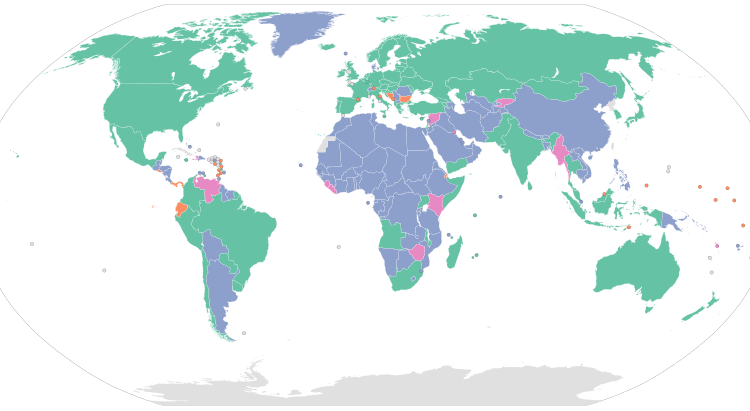

Visa, the global payments technology company, recently received a downgrade from an analyst due to concerns about its growth prospects. The analyst cited several factors contributing to the downgrade, including slowing growth in payment volumes and increased competition from fintech companies.

One of the main concerns is the potential impact of regulatory changes on Visa’s business. As governments around the world tighten regulations on payment processing and data privacy, Visa may face challenges in adapting to these changes.

Despite the downgrade, the analyst acknowledged Visa’s strong financial position and long-term growth prospects. The company has a dominant market share in the payments industry and continues to innovate in order to stay ahead of the competition.

In conclusion, while there are some concerns about Visa’s growth in the near term, the company’s strong fundamentals and long-term prospects make it an attractive investment for many investors.