Investors skeptical about sustainability of market moves

- Argentina stocks and bonds surge after Milei’s victory

- Investors skeptical about sustainability of market moves

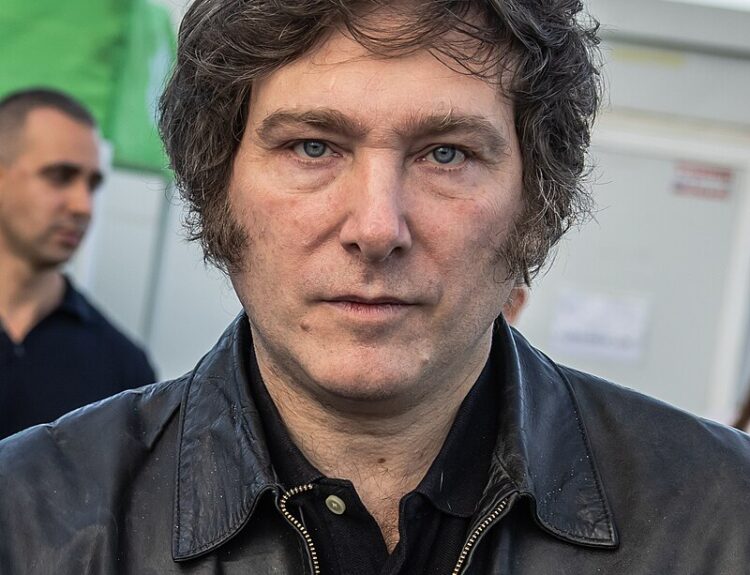

- Milei plans to slash the size of the Argentinian state and replace the peso with the U.S. dollar

- Argentine bonds still suggest a reasonable chance of default

- Investors wary of increasing exposure to Argentine markets

- Milei may face difficulties in enacting his radical policies

- Optimistic views highlight the potential for improvement in the Argentine economy

Argentina stocks and bonds experienced a surge following the unexpected electoral win of radical libertarian economist Javier Milei. Milei’s plans to slash the size of the Argentinian state, close the central bank, and replace the volatile peso with the U.S. dollar have sparked market optimism. However, investors remain skeptical about the sustainability of these initial market moves. Argentine bonds, although rallying, still indicate a reasonable chance of default. Investors are cautious about increasing their exposure to Argentine markets due to doubts about Milei’s ability to enact his policies. Milei may face major opposition, including from trade unions, as he attempts to implement his radical reforms. Additionally, the replacement of the peso with the dollar may prove challenging. While some optimistic views highlight the potential for improvement in the Argentine economy, others emphasize the need for fiscal spending cuts and deregulation to achieve dollarization. Overall, the future of Argentina’s markets and economy remains uncertain.

Factuality Level: 6

Factuality Justification: The article provides information about the market reaction to Javier Milei’s electoral win in Argentina and includes quotes from analysts expressing doubts about the sustainability of the market moves. It also mentions Milei’s radical plans and the skepticism of investors regarding his ability to enact his policies. The article presents different perspectives on the potential challenges Milei may face, including opposition from trade unions and difficulties in replacing the peso with the dollar. It also includes an optimistic take on the potential for improvement in the Argentine economy. Overall, the article provides a range of viewpoints and presents both positive and negative aspects of Milei’s presidency.

Noise Level: 3

Noise Justification: The article provides information on the market reaction to Javier Milei’s electoral win in Argentina and his radical plans for the country. It includes quotes from analysts and experts who express doubts about the sustainability of the market moves and the feasibility of Milei’s policies. The article also mentions the challenges Milei may face in implementing his proposed changes, such as opposition from trade unions and the difficulty of dollarization. However, it also includes a more optimistic take on the potential for improvement in the Argentine economy. Overall, the article stays on topic and provides some analysis and insights, but it lacks in-depth analysis and evidence to support its claims.

Financial Relevance: Yes

Financial Markets Impacted: Argentina stocks and bonds

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article discusses the impact of Javier Milei becoming Argentina’s next president on the country’s financial markets. While stocks and bonds initially surged, investors have doubts about the sustainability of these market moves. The article does not mention any extreme events or their impact.

Private Companies: Oldfield Partners,BancTrust & Co,Macquarie,Western Asset Management

Key People: Javier Milei (radical libertarian economist), Charles Sunnucks (emerging markets analyst at Oldfield Partners), Ramiro Blazquez (head of research and strategy at BancTrust & Co), Mauricio Macri (former President of Argentina), Scott Grannis (former chief economist of Western Asset Management)

www.marketwatch.com

www.marketwatch.com