Pharma Giant AstraZeneca Surpasses Estimates and Ups Outlook

- AstraZeneca raises full-year guidance after beating revenue and earnings expectations

- Core EPS decreased to $1.98 from $2.15 due to one-off gains in the prior year period

- Revenue for Q2 rose to $12.94 billion from $11.42 billion

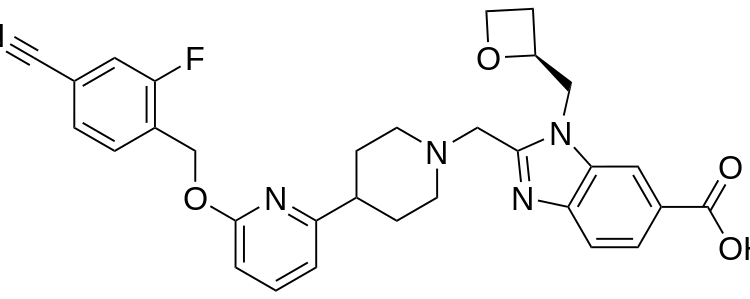

- Oncology segment revenue grew 15% driven by Imfinzi, Tagrisso and Enhertu

- Research and development expenses increased by 13% in Q2

- Interim dividend lifted by 7 cents to $1.00

AstraZeneca has reported better-than-expected second-quarter results, leading to an increase in its full-year guidance. The company now anticipates mid-teen percentage growth for core earnings per share and total revenue at constant currencies, up from low double-digit to low teen range previously. Core EPS fell to $1.98 due to one-off gains in the prior year period. Revenue reached $12.94 billion, with a 15% increase in its oncology segment driven by cancer drugs Imfinzi, Tagrisso, and Enhertu. R&D expenses rose by 13%. The interim dividend increased to $1.00.

Factuality Level: 8

Factuality Justification: The article provides accurate and objective information about AstraZeneca’s financial performance, including revenue growth, core earnings per share, and increased investments in its pipeline. It also includes relevant details such as the company’s preferred metric for earnings and a comparison to analyst expectations. However, it lacks some context or background information on the company and could be more concise.

Noise Level: 3

Noise Justification: The article provides relevant financial information about AstraZeneca’s performance and updates on its guidance for the year. It includes specific numbers and comparisons with previous periods, as well as details on key products and investments in research and development. However, it lacks analysis or contextualization of these results within the broader pharmaceutical industry or market trends.

Public Companies: AstraZeneca (AZN)

Key People: Helena Smolak (Writer)

Financial Relevance: Yes

Financial Markets Impacted: AstraZeneca’s stock price and pharmaceutical industry

Financial Rating Justification: The article discusses AstraZeneca raising its full-year guidance and beating analysts’ expectations, which can impact the company’s stock price and the overall pharmaceutical industry.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no extreme event mentioned in the article. The content discusses AstraZeneca’s financial performance and growth.

www.wsj.com

www.wsj.com