Wall Street Wants You to Be Manic. Be Focused Instead.

- Focus on long-term investments instead of daily market fluctuations

- Identify enduring investment themes such as AI, privatization of finance, and aging population

- Create a compounding engine through dividend reinvestment or selling options

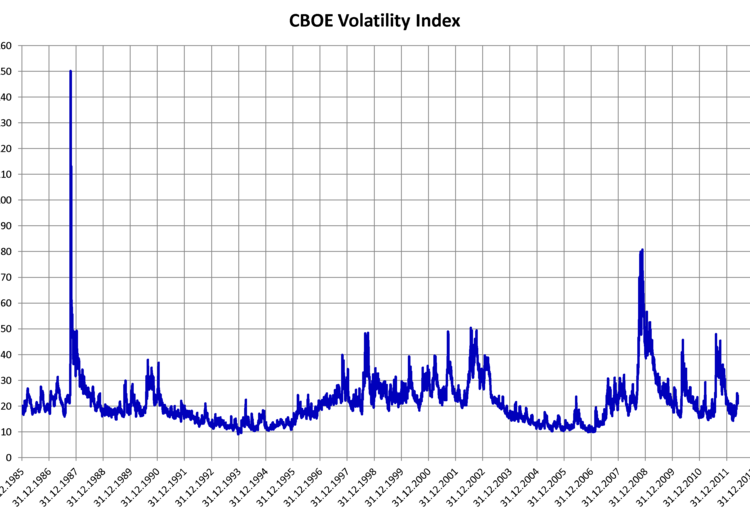

- Ignore short-term market noise and volatility

- Sell puts on stocks you want to buy and calls on stocks you’re willing to sell at higher prices

Wall Street often encourages short-term thinking, but successful investors should focus on long-term strategies and enduring themes like AI, privatization of finance, and the aging population. Create a portfolio with quality blue-chip stocks that pay dividends and use compounding returns through reinvestment or selling options. Ignore daily market fluctuations and volatility to achieve consistent returns.

Factuality Level: 8

Factuality Justification: The article provides useful advice on investing strategies and emphasizes the importance of focusing on long-term investments rather than short-term events. It also offers practical tips for generating compounding returns through options trading. While it does not contain any major inaccuracies or logical fallacies, it could be improved by providing more specific examples and data to support its claims.

Noise Level: 7

Noise Justification: The article contains some useful investment advice but is also filled with unnecessary filler content such as advertisements and repetitive information.

Public Companies: Oppenheimer (OPY)

Key People: Warren Buffett (Investor), Thomas Peterffy (Options Trader), Michael Schwartz (Chief Options Strategist at Oppenheimer)

Financial Relevance: Yes

Financial Markets Impacted: The article discusses the impact of Federal Reserve interest-rate decisions on financial markets, focusing on the importance of long-term investing and using options strategies.

Financial Rating Justification: The article talks about the impact of short-term events like Federal Reserve interest-rate decisions on financial markets and suggests a focus on long-term investments in blue-chip stocks and options strategies to achieve consistent returns.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no mention of an extreme event in the text.

Move Size: No market move size mentioned.

Sector: All

Direction: Up

Magnitude: Medium

Affected Instruments: Stocks

www.barrons.com

www.barrons.com