Opportunities and challenges in the banking sector

- Goldman Sachs, KeyCorp, and Webster Financial identified as potential opportunities

- Bank earnings focused on outlook rather than earnings

- Uncertainty around Treasury yields and credit quality

- Goldman Sachs can focus on investment banking

Goldman Sachs, KeyCorp, and Webster Financial have been identified as potential opportunities in the banking sector. Bank earnings are expected to focus on the outlook rather than earnings. Uncertainty around Treasury yields and credit quality could impact bank stocks. However, Goldman Sachs, having shed its money-losing consumer businesses, can focus on investment banking. With rates normalizing, deal activity and IPOs are expected to boost Goldman Sachs’ shares. While the year may be bumpy for banks, there are still plenty of opportunities to be found.

Public Companies: Goldman Sachs (GS), JPMorgan Chase (JPM), Citigroup (C), Bank of America (BAC), Wells Fargo (WFC), First Republic Bancorp (FRC), Silicon Valley Bank (SIVB), Signature Bank (SBNY), KeyCorp (KEY), Webster Financial (WBS)

Private Companies:

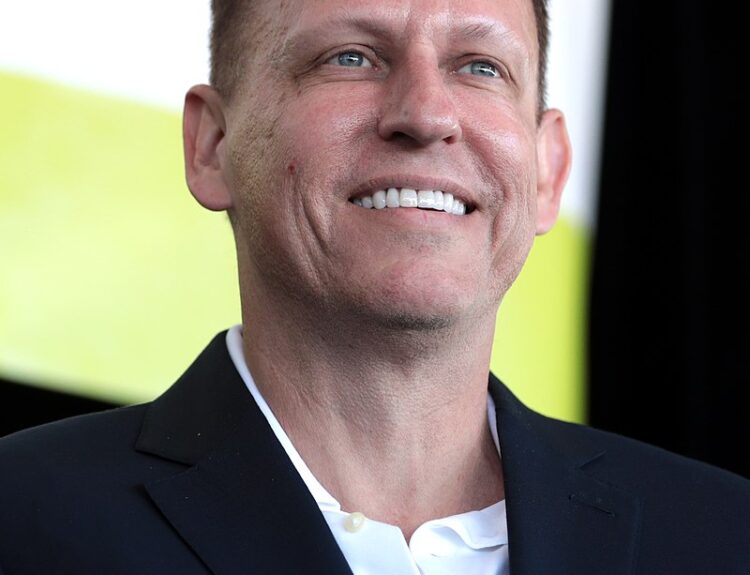

Key People: Christopher Marinac (Analyst at Janney Montgomery Scott)

Factuality Level: 7

Justification: The article provides information about upcoming bank earnings and the potential challenges and opportunities for banks in 2024. It mentions specific banks and their potential performance, as well as factors that could impact their earnings. While the article does not provide extensive evidence or sources for its claims, it does not contain obvious misinformation or bias. However, it does include some speculative statements and predictions that may not be entirely accurate.

Noise Level: 3

Justification: The article provides relevant information about the upcoming bank earnings and the potential challenges and opportunities for banks in 2024. However, it lacks depth and analysis, and the information provided is quite general and repetitive. It also does not provide any evidence or data to support its claims. Overall, the article contains some noise and filler content.

Financial Relevance: Yes

Financial Markets Impacted: Banking sector

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article discusses the upcoming bank earnings and the outlook for the banking sector. It mentions the impact of the Federal Deposit Insurance Corp.’s assessment on large and midsize banks following the collapse of certain banks. It also highlights potential issues such as the direction of Treasury yields and credit quality. However, there is no mention of any extreme events or their impact.

www.marketwatch.com

www.marketwatch.com