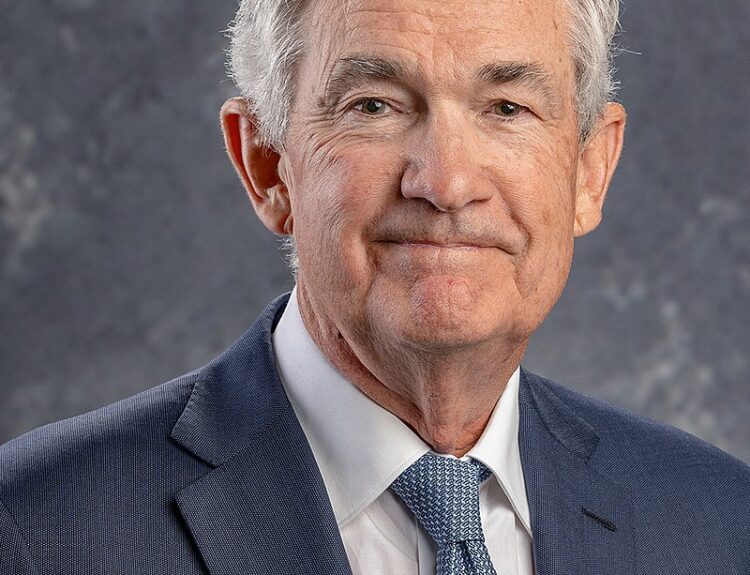

President emphasizes fairness and strengthening the program

- President Biden wants the wealthiest to pay more into Social Security

- Millionaires and billionaires pay less into Social Security than everyday workers

- Program’s trust funds expected to be depleted in the next decade

- Beneficiaries may see a 20% cut to their benefits

- Biden vows to stop any attempts to cut Social Security or raise the retirement age

- Workers stop paying into Social Security when they reach the income cap

- Highest earners pay a smaller share of their income toward Social Security than lower-earning workers

- Wealthiest Americans have multiple sources of income not currently taxed for Social Security

- Cuts to Social Security benefits are inevitable if funding issues are not addressed

- Proposals in Congress aim to require higher earners to contribute more to the program

President Biden highlighted the disparity between the amount of Social Security contributions made by millionaires and billionaires compared to everyday workers during his State of the Union address. He emphasized the need to address the program’s funding issues and ensure that the wealthy pay their fair share. Currently, the program’s trust funds are projected to be depleted in the next decade, potentially leading to a 20% cut in benefits for beneficiaries. Biden pledged to protect Social Security and Medicare from cuts or increases in the retirement age. He also highlighted the income cap that determines when workers stop contributing to Social Security, with the highest earners paying a smaller share of their income compared to lower-earning workers. The president acknowledged that while millionaires and billionaires pay less into Social Security as a percentage of their incomes, this is a common trend globally. However, he emphasized that the wealthiest Americans have additional sources of income that are not currently taxed for Social Security, such as investment income. Biden did not provide specific solutions to address the program’s funding issues, but experts suggest that some form of cuts or tax increases will be necessary. Various proposals have been introduced in Congress, aiming to require higher earners to contribute more to the program and close tax loopholes. The president’s focus on fairness and strengthening Social Security points towards the need for bipartisan cooperation to find a solution.

Factuality Level: 7

Factuality Justification: The article provides a detailed overview of President Biden’s proposal to make the wealthiest Americans pay more into Social Security. It includes quotes from Biden’s State of the Union address, expert opinions, and information on current Social Security funding issues. The article also mentions different legislative proposals related to Social Security reform. While there are some opinions presented, the article overall provides a factual account of the topic.

Noise Level: 3

Noise Justification: The article provides a detailed analysis of President Biden’s proposal to make the wealthy pay more into Social Security. It includes perspectives from different experts and politicians, as well as information on the current state of the program and potential solutions. The article stays on topic and supports its claims with quotes and data. However, there are some repetitive statements and unnecessary details that could be considered noise.

Financial Relevance: Yes

Financial Markets Impacted: The article does not provide specific information about financial markets or companies impacted.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article discusses President Biden’s proposal to make the wealthy pay more into Social Security. While this has financial implications, there is no mention of an extreme event or specific impact on financial markets or companies.

Private Companies: American Enterprise Institute,Center on Budget and Policy Priorities

Key People: Joe Biden (President), Nikki Haley (Former presidential candidate), Andrew Biggs (Senior fellow at the American Enterprise Institute and Biden’s Republican nominee for the Social Security Advisory Board), Kathleen Romig (Director of Social Security and Disability Policy at the Center on Budget and Policy Priorities), John Larson (Democratic Connecticut Representative), Sheldon Whitehouse (Democratic Rhode Island Senator)

www.marketwatch.com

www.marketwatch.com