Crypto Investors Eye Job Data and Geopolitical Events

- Bitcoin may slide to $55,000 due to U.S. jobs report and Middle East tensions

- Crypto investors closely watching U.S. jobs report and geopolitical events in the Middle East

- Bitcoin has fallen 6.5% over the past five days

- Fed-funds futures indicate a 46.3% likelihood of a 75 basis point rate cut by year’s end

- Economists expect 150,000 jobs added in September with unemployment rate at 4.2%

- Stronger than expected jobs data could lead to underperformance of risk assets

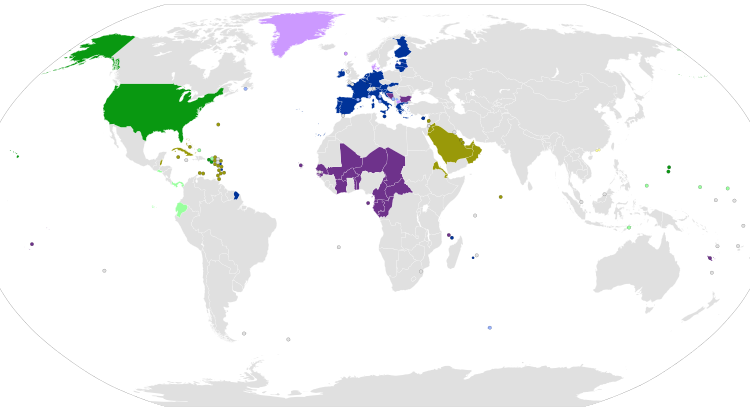

- Heightened tensions in Middle East may cause a ‘risk-off’ environment

Crypto investors are keeping a close watch on the upcoming U.S. jobs report and ongoing tensions in the Middle East to determine Bitcoin’s near-term direction. The largest cryptocurrency by market capitalization, Bitcoin, has fallen 6.5% over the past five days, trading at around $60,582 as of early afternoon Thursday. If the U.S. jobs report meets or exceeds expectations, risk assets may underperform. However, heightened tensions in the Middle East could lead to a ‘risk-off’ environment, potentially pushing Bitcoin down to $55,000. Analysts at QCP Capital suggest that Bitcoin’s recent price action indicates a short-term bearish outlook.

Factuality Level: 8

Factuality Justification: The article provides accurate and objective information about the impact of U.S. jobs report and geopolitical tensions on bitcoin prices, citing expert opinions and including relevant data such as bitcoin’s performance and market trends. It also includes forecasted economic indicators and potential future scenarios based on these factors.

Noise Level: 6

Noise Justification: The article provides relevant information about the impact of U.S. jobs report and geopolitical tensions on bitcoin prices, but it also includes some repetitive information and focuses mainly on short-term price movements rather than long-term trends or possibilities.

Public Companies: Galaxy Digital (GLXY), SPDR Galaxy ETFs (SPYG), JPMorgan (JPM)

Key People: Chris Rhine (head of liquid active strategies at Galaxy Digital and portfolio manager at SPDR Galaxy ETFs)

Financial Relevance: Yes

Financial Markets Impacted: Yes

Financial Rating Justification: The article discusses bitcoin prices and their relation to U.S. jobs report and geopolitical tensions in the Middle East, which can impact financial markets and companies involved in cryptocurrency trading.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no extreme event mentioned in the article and it mainly discusses the impact of geopolitical tensions on bitcoin prices.

Move Size: The market move size mentioned in this article is a 6.5% decrease in bitcoin prices over the past five days.

Sector: Technology

Direction: Down

Magnitude: Medium

Affected Instruments: Stocks

www.marketwatch.com

www.marketwatch.com