Bank of England Likely to Lower Rates Again in November

- BOE Governor Andrew Bailey sees key interest rate on a gradual downward path

- Bank of England likely to continue cutting interest rates, but not in a rush

- Investors expect another cut in November with new forecasts for growth and inflation

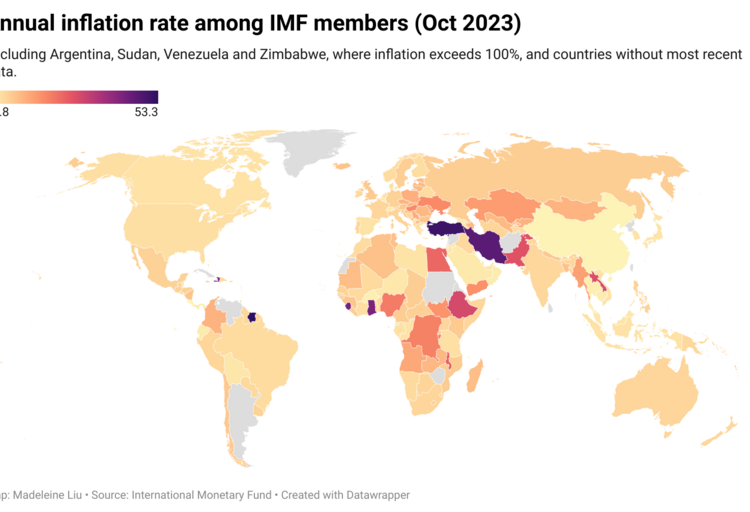

Bank of England (BOE) Governor Andrew Bailey has indicated that the central bank is likely to continue cutting its key interest rate, but not in a hurry. This comes after the BOE left its key rate unchanged on Thursday, following a quarter-point cut in August for the first time since 2016. The Federal Reserve lowered its key rate by half a point the day before and signaled further borrowing cost reductions this year. Inflation has decreased significantly, according to Bailey, but he doesn’t expect interest rates to return to pandemic-level lows due to the unique economic shocks experienced during that time. Investors anticipate another cut in November when new growth and inflation forecasts are published.

Factuality Level: 8

Factuality Justification: The article provides accurate and objective information about the Bank of England’s stance on interest rates, quotes from Governor Andrew Bailey, and discusses the current economic situation. It also mentions the Federal Reserve’s actions and investor expectations. However, it lacks some details about inflation targets and specific numbers.

Noise Level: 7

Noise Justification: The article provides relevant information about the Bank of England’s stance on interest rates and Governor Andrew Bailey’s comments, but it lacks in-depth analysis or actionable insights. It also contains some repetitive information and does not explore the consequences of decisions on those who bear the risks.

Public Companies: Bank of England (N/A), Federal Reserve (N/A)

Key People: Andrew Bailey (Governor of the Bank of England), Paul Hannon (Writer)

Financial Relevance: Yes

Financial Markets Impacted: Bank of England’s key interest rate

Financial Rating Justification: The article discusses the Bank of England’s potential decision to cut its key interest rate and its impact on financial markets, as well as the expectations of investors regarding future changes in interest rates.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no mention of an extreme event in the text.

Move Size: No market move size mentioned.

Sector: All

Direction: Down

Magnitude: Small

Affected Instruments: Stocks

www.wsj.com

www.wsj.com