BlackRock and Schwab lead the way with top-performing bond ETFs

- Bond ETFs dominate the list of best ETF launches in 2023

- BlackRock Flexible Income ETF and Schwab High Yield Bond ETF named as the top performers

- BlackRock’s ETF offers active management, while Schwab’s ETF cuts costs for investors

- Record number of ETFs launched in 2023, including over 370 active ETFs

- Schwab’s entry into the bond ETF market led to fee cuts for investors

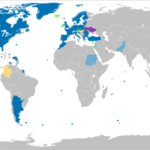

- Honorable mentions for best new ETFs include T. Rowe Price Capital Appreciation Equity ETF and iShares J.P. Morgan Broad USD Emerging Markets Bond ETF

- Worst new ETFs include Volatility Shares 2x Bitcoin Strategy ETF and YieldMax AI Option Income Strategy ETF

A recent report highlights the dominance of bond ETFs in the list of best ETF launches in 2023. The BlackRock Flexible Income ETF and Schwab High Yield Bond ETF were named as the top performers. BlackRock’s ETF offers active management, a feature typically only available in mutual funds, while Schwab’s ETF has cut costs for investors by starting a fee war in the high-yield bond category. The report also mentions the record number of ETFs launched in 2023, with over 370 active ETFs among them. Schwab’s entry into the bond ETF market has led to fee cuts for investors, creating a competitive environment. Other notable mentions for best new ETFs include T. Rowe Price Capital Appreciation Equity ETF and iShares J.P. Morgan Broad USD Emerging Markets Bond ETF. On the other hand, the worst new ETFs include Volatility Shares 2x Bitcoin Strategy ETF and YieldMax AI Option Income Strategy ETF.

Public Companies: BlackRock (BLK), Schwab (SCHW), Vanguard (VANGUARD), State Street (STT), iShares (ISHARES), Xtrackers (XTRACKERS), T. Rowe Price (TROW), Dimensional (DFA), J.P. Morgan (JPM), ProShares (PROSHARES), C3.ai (AI)

Private Companies:

Key People: Bryan Armour (Morningstar’s director of passive strategies research), Rick Rieder (BlackRock’s chief investment officer of global fixed income), Stuart Barton (CIO of Volatility Shares), Jay Pestrichelli (CEO of ZEGA Financial)

Factuality Level: 7

Justification: The article provides information about the best and worst new exchange-traded funds (ETFs) launched in 2023 according to Morningstar. It includes details about the BlackRock Flexible Income ETF and the Schwab High Yield Bond ETF, as well as their performance and fees. The article also mentions other notable new ETFs and highlights the worst performers. The information provided is specific and based on Morningstar’s report, but it lacks broader context and analysis.

Noise Level: 6

Justification: The article provides information on the best and worst new exchange-traded funds (ETFs) launched in 2023. It mentions the BlackRock Flexible Income ETF and the Schwab High Yield Bond ETF as the best, highlighting their benefits for investors. It also discusses the impact of Vanguard and Schwab on fee competition in the ETF market. The article provides data on the performance and expense ratios of the mentioned ETFs. However, it lacks in-depth analysis and does not explore the long-term trends or consequences of these ETF launches. It also does not provide actionable insights or solutions for investors.

Financial Relevance: Yes

Financial Markets Impacted: The article discusses the launch of exchange-traded funds (ETFs) and their impact on the bond ETF market. It mentions BlackRock and Schwab as companies that have launched successful ETFs, and it also highlights the fee cuts made by Schwab that have influenced competitors to lower their fees as well.

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article primarily focuses on the launch of ETFs and their impact on the financial markets, specifically in the bond ETF market. It does not mention any extreme events or their impact.

www.marketwatch.com

www.marketwatch.com