Western-wear retailer’s strong Q1 performance boosts stock price

- Boot Barn Holdings’ shares rise in premarket trading

- Sales trending above expectations for the first quarter

- Consolidated same-store sales up 1.4%

- Store comps up 0.8%, e-commerce up 6.7%

- Analysts expect a same-store sales decline of 4.2% on average

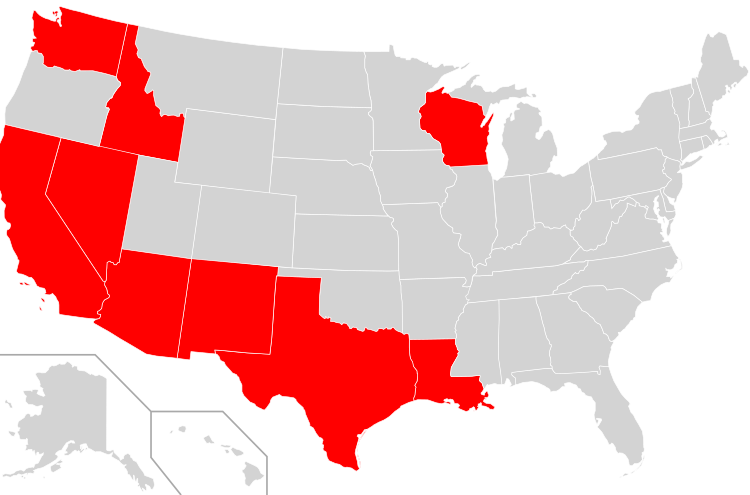

Boot Barn Holdings, a Western-wear retailer, reported that its sales for the first nine weeks of its fiscal first quarter are performing better than anticipated. The company’s consolidated same-store sales increased by 1.4%, with store comps up 0.8% and e-commerce sales rising by 6.7%. Initially, Boot Barn had projected a decline of 2.5% to 4.5% for the quarter ending June 29, with retail store same-store sales down 3% to 5%, and e-commerce sales remaining flat or increasing by up to 2%. Analysts estimated an average same-store sales drop of 4.2%. The company attributes this improvement to a sequential uptick in sales across all major product categories and regions. As a result, Boot Barn’s shares surged in premarket trading.

Factuality Level: 8

Factuality Justification: The article provides accurate and objective information about Boot Barn Holdings’ sales performance, including specific numbers and comparisons to previous expectations. It also includes relevant details about the company’s regional performance and stock price changes.

Noise Level: 4

Noise Justification: The article provides relevant information about the company’s sales performance and updates on its expectations for the quarter, but it lacks a deeper analysis or exploration of the reasons behind the positive results and their implications for the industry or the market. It also does not offer any actionable insights or new knowledge beyond the basic reporting of financial data.

Public Companies: Boot Barn Holdings (BOOT)

Key People:

Financial Relevance: Yes

Financial Markets Impacted: Boot Barn Holdings stock

Financial Rating Justification: The article discusses the performance of Boot Barn Holdings, a Western-wear retailer, and its sales trending above expectations, which would impact the company’s stock price in financial markets.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no extreme event mentioned in the article.

www.marketwatch.com

www.marketwatch.com